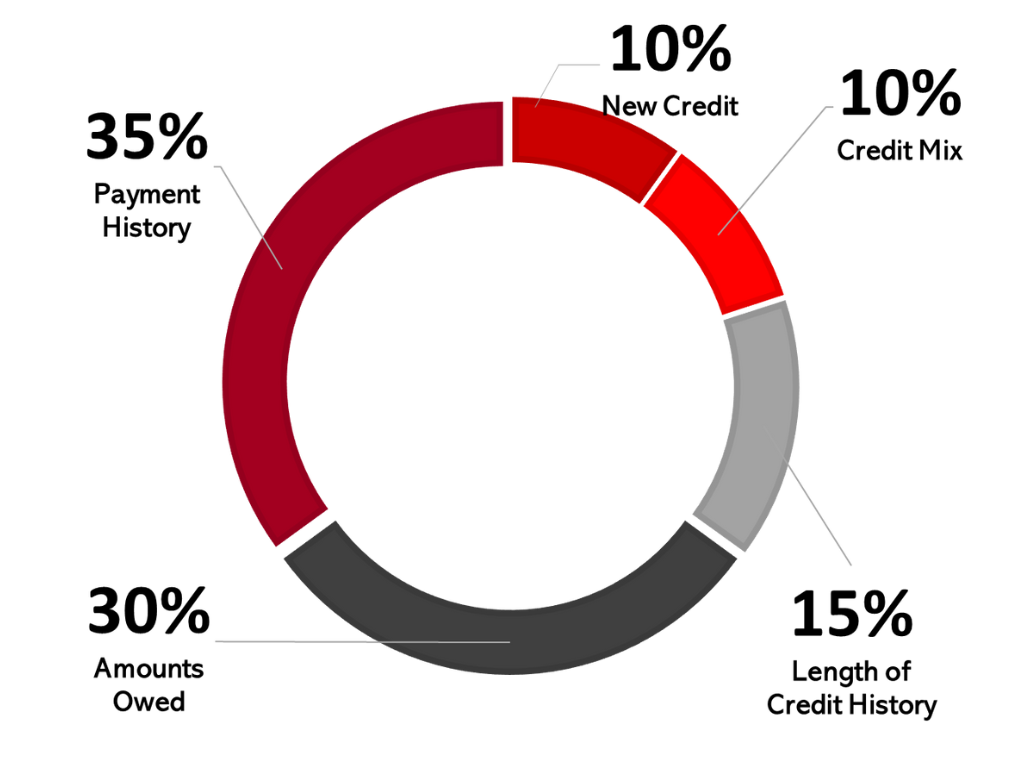

Between its’ live music venues, prime real estate, and mouth-watering selection of restaurants, it’s no surprise that Fort Worth is a place many call home. There’s nothing like getting a taste of urban sophistication paired with Western influences and a smidge of cowboy culture. How could Fort Worth residents truly enjoy all the area has to offer, however, if they’re drowning in bad credit scores? Averaging a credit score of about 636, Fort Worth holds one of the lowest scores when compared to neighboring cities like Houston (642) and El Paso (650). On average, consumers in this region are also $26,599 in debt. Lenders and creditors commonly use FICO® scoring standards to predict your credit risk and assess the likelihood that you’ll return borrowed funds. The three-integer number, which ranges from 300 to 850, is calculated using a formula that analyzes your debt ratio, payment history, accounts owed, length of credit history, new credit, and the credit mix you have. Bad credit can happen to anyone. Financial hardship, even if it’s a short stretch of time, can lead to missed payments and maxed out credit cards. These mistakes are often a catalyst for more pressing, negative events, such as having your vehicle repossessed, filing for bankruptcy, or foreclosure on your home.

How Does Credit Restoration Work In Fort Worth?

Identifying and diagnosing all the hiccups in your credit report involves collecting your record from each of the three main reporting agencies in the U.S. – Equifax, TransUnion, and Experian. Why is it necessary to get all three? While these credit reporting agencies all assemble information surrounding your financial history and behaviors from creditors, each is furnished data from different contributors – aka credit card companies, banks, healthcare providers, debt collectors, utility/phone companies, and lenders. For example, there may be missing information or an error on one credit report that doesn’t appear on the other two. In collaboration with an independent law firm, The Phenix Group works to resolve any items on your credit report that are outright incorrect or require updating. Not only are our credit solutions deliberate and timely, tailored to strengthen your score, but our specialists have mastered the art of grappling with the bureaus and creditors that refuse to acknowledge inaccurate information. Despite creditors profiting from negative data reports, they are governed by certain laws, such as the Fair Credit Reporting Act, which require them to act in your best interests.

Credit Repair Company Reviews

I have worked with a few other companies in the past and in no way received the support, or results we did with The Phenix Group

Jacquelyn Juarez

from Google

No gimmicks only results. The process is simple but you have to be committed and follow their process in order to get the best results. #ThePhenixGroup

Javier Hernandez

from Google

Phenix Group is hands down the best credit repair company for anyone looking to improve their credit to buy a home, car, etc. As a lending professional, I can attest that they are head and shoulders above other credit restoration outfits.

Sean Spacil

from Google

I followed their plan and MAN oh MAN did they Deliver! 3 months and 150 points later and I just CLOSED ON MY HOME!! BEST DECISION I EVER MADE! WORTH EVERY PENNY!

Stephen Anderson

from Google

Working with The Phenix Group was like working with family. Not only were they incredibly knowledgable, attentive, and on top of EVERYTHING, they were kind, sincere, and truly cared about our goals and our future happiness!

Zaena Cherif

from Google

What Credit Repair Services We Offer In Fort Worth

Home Ownership

Home Ownership-Our flagship service! All of our credit repair analysts are well-versed in the mortgage and underwriting requirements. We will work with you (the buyer), your lender, and the real estate professional involved in your purchase to ensure we are able to hit your closing date deadline with efficiency. If you are a first time homebuyer and want help with finding a reputable lender or realtor who will work for you during your home buying process, TPG has a network of trusted preferred mortgage professionals we can refer to you. We take an all-inclusive approach. Our process includes the creidt reporting agencies (CRA’s), creditors and third-party collection agencies who have reported erroneous information on your credit report. Going after the inaccurate information on all platforms helps create a permanent result. The Phenix Group will work diligently on your behalf to help raise your credit score. We’ve helped thousands of people in your position, and we can do the same for you. Contact us today for a no cost credit consultation.

Read More

Business Financing

There are a few options to secure a business loan. Obtaining the funds is the ultimate goal; however, securing those funds at a favorable interest rate can be equally impactful. The most important factor considered in securing any business loan is your overall credit rating. The Phenix Group credit repair company can help restore your credit scores in the shortest possible time, so you can secure your business financing. TPG, a reputable credit repair company, has built relationships with a plethora of business finance lenders to help with all of your business financing needs. Schedule a free credit analysis today to learn more about the credit plans available to you and your business.

Read More

Home/Auto Refinancing

Sometimes we are forced into a loan with significantly higher interest rates. Those rates do not have to be a life sentence, fortunately. Home and Auto refinancing are often able to be obtained after successful completion of our credit repair program. Allowing you to not only obtain lower interest rates but to ultimately substantially lower your debt to income ratio (DTI) in the process. Schedule your free credit analysis today to see how we can help you.

Read More

Just Because

It’s no secret, credit repair as it relates to home buying is our jam; but that doesn’t mean we can’t help the everyday consumer improve their credit score, too. Even if you may not currently be in any other category listed above, your credit is no less important. Honestly, it is much less stressful to have time to prep for whatever your goal is, instead of needing help yesterday. No matter the goal, our credit repair services can help with a custom plan for an overall financial clean up, as well.

Read More

About Us and Credit Repair Fort Worth

The Phenix Group

Once the medical bills have piled up and a few poor financial choices cause your credit score to hurdle into a dark abyss, you’ll find it nearly impossible to find lenders that are willing to work with you. From their perspective, you represent a risky borrower, as your poor credit score communicates a high probability that you could fall behind on loan or credit card payments. Many Fort Worth residents with bad credit will find their applications repeatedly being denied or when they are approved, it’s accompanied by an inflated interest rate. Bad credit scores carry negative repercussions in other areas as well. For instance, many insurance carriers use your credit score as an ingredient to determine an appropriate insurance rate. Don’t be surprised to see a pricey quote after your insurance company factors your bad credit into the equation. Cell phone and utility providers are also wary of poor credit scores, frequently imposing an additional security deposit to protect themselves from potential unpaid contracts. Landlords employ a similar defense mechanism, increasing the amount of the security deposit owed, or worse, denying your lease application altogether.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Don’t Trust Us? Trust Them!

Client Success Story

Meet our Former Client,

Vincenzo

Credit Score: 794 647

I can honestly say, I had a new pep in my step that day. I felt like a new man!

Meet Our Former Client,

Jimmy

Credit Score: 761 560

I was able to stop worrying about if we were going to get our dream home when we got the final approval! They took a ton of bricks off the top of us. We could breathe.

Fort Worth Credit Repair

Working on credit, in a City near you

Bad credit can feel like an unwelcome, ominous shadow that trails you wherever you go. When you’re accompanied by a dark credit cloud, it can completely hijack your financial wellbeing, providing you with declined application after declined application and high interest rates for those few lenders that decide to take a chance on you.

The Phenix Group is committed to helping you kick this uninvited credit-harming companion to the curb once and for all. Your past financial mistakes shouldn’t define your life. Watching good people get penalized for bad credit year after year is what inspired our company to take action. From debt settlements and dispute code removal to re-establishing your credit, The Phenix Group builds personalized credit solutions to help you get the house, car, job, or other item you need to achieve your goals. We believe credit repair is a second chance for our clients to reclaim the lifestyle they deserve, and our experts work tirelessly to produce quick and effective results.