Attorney-Engaged Credit Repair Specialists Backed by Proven Results

At The Phenix Group, we understand how challenging it can be to manage your credit and overcome the setbacks that come with a low credit score. Our mission is simple — to help individuals restore their financial wellbeing through personalized and strategic credit repair. As a trusted credit repair company, we focus on rebuilding financial confidence with a clear and thoughtful approach tailored to each client’s unique situation. Every person’s credit story is different. For some, it means recovering after a job loss or unexpected medical expenses; for others, it’s about correcting reporting errors that have unfairly impacted their credit history. Whatever the cause, our goal is to guide you toward lasting credit health and financial peace of mind.

That’s where our experienced credit experts step in to make a real difference. At The Phenix Group, we don’t believe in cookie-cutter solutions or quick-fix promises that rarely deliver lasting results. Every person’s credit story is different, and your credit report deserves individual attention. Our team takes the time to thoroughly review your full credit profile, identify errors, and understand the deeper factors affecting your credit history. From there, we create a personalized credit repair plan tailored to your exact needs, financial goals, and timeline.

Each strategy we build is designed to strengthen your credit standing efficiently and responsibly. We focus on meaningful progress — not just temporary score boosts — by combining expert analysis with proven dispute methods that comply with federal law. Whether you’re working to remove inaccurate items, recover from bad credit, or simply rebuild your financial reputation, our credit specialists are dedicated to helping you achieve lasting results and renewed confidence in your financial future.

Many credit repair companies make big promises but fail to deliver. At The Phenix Group, we take a different approach. We believe in being open and transparent from day one. Our team clearly explains the entire credit repair process, sets honest expectations, and provides a detailed overview of the credit repair costs before any work begins. People choose us because we focus on results, professionalism, and lasting financial improvement, not empty promises.

Our mission goes beyond simply improving your credit score. We want to help you understand your credit and build healthy financial habits for the future. Our trained credit analysts and credit professionals work side by side with you to identify errors, challenge inaccurate information, and find practical solutions to your credit problems. Through this process, you gain both progress and knowledge. We help provide you the tools and education that will help you protect your financial stability long after your credit repair program ends.

Over the years, The Phenix Group has built a strong reputation in the credit repair industry for delivering ethical, attorney-engaged credit repair services that truly make a difference. We’ve helped people across the country repair their credit history, achieve major goals like buying a home or starting a business, and regain control of their finances.

If you’ve been searching for a reliable credit repair company to help with bad credit, you’ve found the right team. The professionals at The Phenix Group are ready to guide you through every step, from your first credit analysis to the moment you see real improvement on your credit report. Don’t let bad credit hold you back any longer. Let us help you take control of your credit, rebuild your financial foundation, and look forward to a brighter future.

Phenix Group is hands down the best credit repair company for anyone looking to improve their credit to buy a home, car, etc. As a lending professional, I can attest that they are head and shoulders above other credit restoration outfits.

from Google

I followed their plan and MAN oh MAN did they Deliver! 3 months and 150 points later and I just CLOSED ON MY HOME!! BEST DECISION I EVER MADE! WORTH EVERY PENNY!

The Phenix Group Credit Services offers a combined experience of over 80 years to help you improve your credit score. As one of the best credit repair companies, our team of credit repair specialists works closely with you to identify errors or inaccuracies on your credit report and dispute them directly with the credit bureaus. We also provide personalized credit education to help you manage debt, reduce credit utilization, and make smarter financial decisions. In addition, we equip you with tools to monitor your credit, keeping you informed of changes and protecting against identity theft or fraud. So if you’re looking to improve your credit score and take control of your financial future, look no further than our credit repair services. Below are some examples of how we can help.

Home Ownership-Our flagship service! All of our credit repair analysts are well-versed in the mortgage and underwriting requirements. We will work with you (the buyer), your lender, and the real estate professional involved in your purchase to ensure we are able to hit your closing date deadline with efficiency. If you are a first time homebuyer and want help with finding a reputable lender or realtor who will work for you during your home buying process, TPG has a network of trusted preferred mortgage professionals we can refer to you. We take an all-inclusive approach. Our process includes the creidt reporting agencies (CRA’s), creditors and third-party collection agencies who have reported erroneous information on your credit report. Going after the inaccurate information on all platforms helps create a permanent result. The Phenix Group will work diligently on your behalf to help raise your credit score. We’ve helped thousands of people in your position, and we can do the same for you. Contact us today for a no cost credit consultation.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Securing a business loan can be a daunting task, but there are several options available for those looking to obtain financing. While the ultimate goal is to obtain the funds needed, securing those funds at a favorable interest rate can be equally important. One of the most critical factors in securing any business loan is your overall credit rating. This is where the Phenix Group credit repair company comes in – they can help restore your credit scores in the shortest possible time, so you can secure your business financing. The Phenix Group is a reputable credit repair company that has built strong relationships with a wide range of business finance lenders. By partnering with The Phenix Group, you gain access to a plethora of business financing options that can help you achieve your goals. Their team of experts will work with you to create a customized credit plan that meets your specific needs and goals. If you are interested in exploring your options for business financing, The Phenix Group offers a free credit analysis to help you get started. Schedule your appointment today to learn more about the credit plans available to you and your business. With the help of The Phenix Group, you can take the first step towards securing the financing you need to achieve your business goals.

It’s no secret that high interest rates on loans can be a major burden, causing financial stress and making it difficult to make ends meet. But the good news is that there are options available to help you get back on track. Through our credit repair program, we can help you obtain home and auto refinancing with lower interest rates, which will not only reduce your monthly payments but will also help you substantially lower your debt to income ratio (DTI). Refinancing your home can provide several benefits. One of the most significant advantages is the potential to save money on your monthly mortgage payments. Refinancing can allow you to secure a lower interest rate, which can reduce your monthly payments and save you money over the life of your loan. Another benefit of refinancing is that it can provide you with access to cash that you can use for home improvements, paying off debt, or other expenses. This is known as a cash-out refinance, and it involves borrowing more than the balance remaining on your current mortgage. Refinancing can also help you to pay off your mortgage faster, as you may be able to secure a shorter loan term or a lower interest rate. This can save you thousands of dollars in interest over the life of your loan. If you are considering refinancing your home, it is important to weigh the costs and benefits carefully. By taking advantage of our free credit analysis, we can help you identify any issues with your credit and provide you with the necessary tools to repair it. Our team of experts will work with you to develop a personalized plan to improve your credit score, so you can qualify for better loan terms and take control of your finances. Don’t let high interest rates hold you back any longer. Contact us today to learn more about our credit repair program and how we can help you achieve your financial goals.

Credit repair is a crucial process for anyone who wants to improve their credit score. It can be especially important for those looking to buy a home, but it is just as significant for everyday consumers-even if you have no immediate need for a purchase, things sometimes just happen, it is best to have your credit score ready for whatever life throws your way. It is essential to keep your credit score in good standing. It is much easier to plan for the future when you have time to prepare, rather than waiting until the last minute and needing help immediately. Our credit repair services offer custom plans to help you clean up your finances. We can help you improve your credit score and achieve your financial goals. Our team of experts will work with you to develop a personalized plan that fits your needs and budget. We understand that everyone’s situation is unique, which is why we take the time to get to know you and your financial goals. Our goal is to help you achieve financial freedom and peace of mind. We believe that everyone deserves a second chance and that it is never too late to start improving your credit score. Our credit repair services are designed to help you take control of your finances and achieve your financial goals. Contact us today to learn more about how we can help you improve your credit score and achieve financial freedom..

At The Phenix Group, we are passionate about helping individuals regain control of their financial future—especially through expert credit repair and education. As part of Phenix Group Credit Services, we believe we have some of the most knowledgeable and experienced professionals in the industry who are committed to helping you rebuild your credit. No matter how damaged your credit may be, our team is confident that our proven services can make a difference. However, success depends on one critical element—your active participation. Our personalized and fully compliant credit repair plans are designed to be collaborative, combining your commitment with the guidance of a seasoned credit repair specialist.

To get started on fixing your credit, simply click below. Improving your credit score is a joint effort between you and our top analysts at The Phenix Group, who will support you every step of the way. As one of the best credit repair companies in the industry, our process is aligned with the Credit Repair Organizations Act and tailored to meet your unique financial needs. Even those with the lowest credit scores can experience substantial improvements with consistent effort and our support. Remember, credit repair is not just about numbers—it’s about unlocking future opportunities, including mortgage approval. Your credit score plays a key role in securing a home loan, and without it, you could face higher interest rates or be denied altogether.

That’s why Phenix Group Credit Services focuses not only on improving your credit score, but also on educating you about important factors like income stability and debt-to-income ratio—key considerations for lenders. With a personalized credit strategy from The Phenix Group, and a commitment to follow through, you can rebuild your credit, regain buying power, and achieve your long-term goals. We understand that the process can feel overwhelming, but with the guidance of a trusted credit repair specialist, you don’t have to navigate it alone. We are committed to equipping you with the knowledge, tools, and ongoing support needed to succeed.

At The Phenix Group, we understand that trust is the cornerstone of any successful relationship, especially when it comes to credit. That’s why we’re proud to let our clients speak for us. We believe that by sharing their experiences, potential clients can get an honest and transparent look at our work. Our clients come from all walks of life and industries, and we’re grateful for each and every one of them. They’ve been kind enough to leave us glowing reviews, testimonials, and referrals, all of which we take to heart. Our clients have been consistently impressed with our level of professionalism, attention to detail, and commitment to their credit repair success. We’re honored to have earned their trust and will continue to work tirelessly to maintain it. So if you’re on the fence about working with our credit experts, take a look at the reviews and see what our clients have to say. We’re confident that their words will speak for themselves.

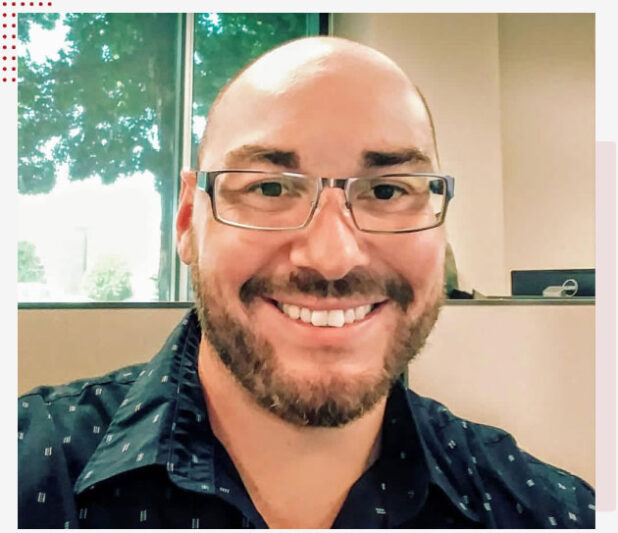

Meet our Former Client,

I can honestly say, I had a new pep in my step that day. I felt like a new man!

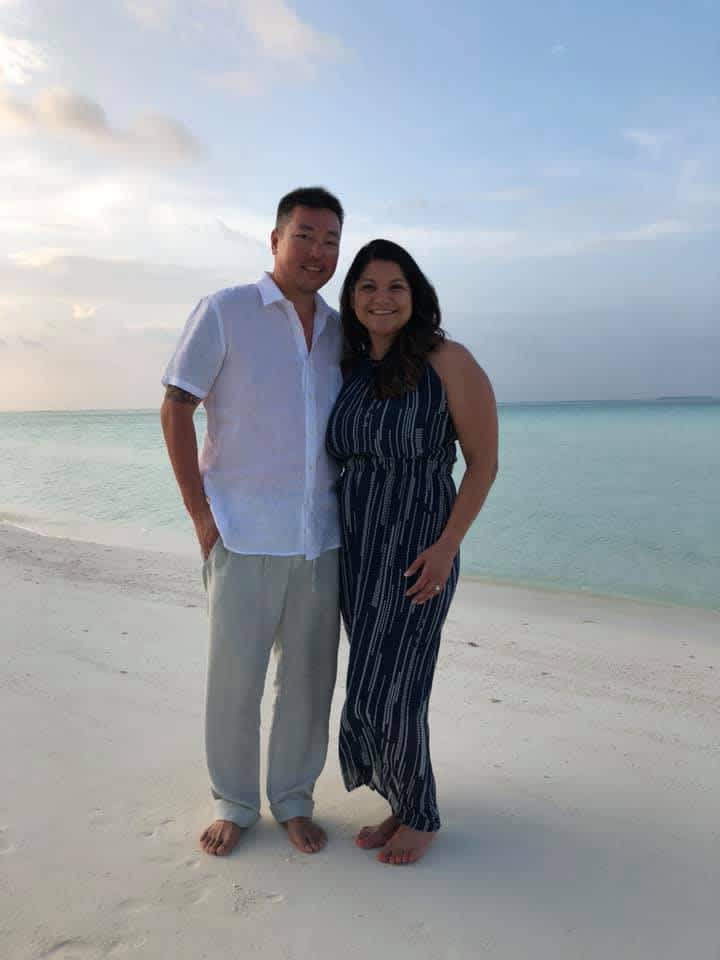

Meet our Former Client,

I was able to stop worrying about if we were going to get our dream home when we got the final approval! They took a ton of bricks off the top of us. We could breathe.

We encourage consumers to get credit and financial education! The more information you have, the better equipped you are to improve your credit history. If our credit repair services are offered this will be part of the analysts’ credit recovery plan. If the individual simply has no credit on their report, we are more than happy to explain how to establish, maintain, and grow your credit score. The credit repair industry can be difficult to navigate, and our services are here to help you through every step of improving your score to help you reach your personal finance goals no matter how bad your credit profile is. Credit companies can help consumers understand everything from credit utilization scores and loans to report dispute and credit improvement. Our credit experts can help you understand a variety of topics such as how to navigate your loans, credit cards, money management, and more.

Unfortunately, opening short term personal loans can have a negative effect on credit and your scores.Short term loans are typically not opened long enough to be effective and aren’t always a good financial investment for your personal credit. Loans can also give the impression that you had to borrow money to get by when you just wanted to build credit and improve your score. Your credit report and credit bureaus don’t know the difference, so any potential pros don’t outweigh the cons of short-term personal loans.

Late payments on your home mortgage loan, credit cards, debt payment, or life insurance may show up as negative items on your credit report and cause bad credit. Depending on the circumstances behind the late debt payment and fees, it may be possible to have the payment history corrected or removed from your credit report. You can talk to one of our credit specialists about your credit report and learn about the repair options available.

Most of our clients see results on their credit score in as little as 60 days from when they start using the best credit repair services, however, the credit program can take up to 6-12 months to complete and to see a difference on your report. Remember, this isn’t just credit repair, and everyone’s situation and personal finance goals are unique. We offer a free credit analysis to determine program candidacy and the estimated credit program duration.

Everyone’s credit is different, so the time frames for fixing bad credit and your credit accounts can vary. After we analyze the reports and develop our game plan during your free credit consultation, we can determine how long it may take to repair your credit and improve your score. The time frame will vary based on your financial history, credit cards, loans, mortgage, debt, and other financial factors.

Credit repair is an in-depth process of improving your credit file by the removal of erroneous, outdated, fraudulent, and unverifiable information from your report. Repair companies help clients remove negative items from credit reports. The goal of credit services is to increase your credit score so you can qualify for better interest rates on loans, credit cards, and other forms of credit. The credit repair process usually involves a combination of tools, including credit counseling, debt settlement, credit monitoring and account dispute resolution. Sometimes, repairing credit can also involve personal bankruptcy. If you feel overwhelmed by the credit repair process, The Phenix Group can help–reach out today to schedule a credit repair consultation, and we’ll do the heavy lifting for you to help get your credit back in good shape.

Cost of legitimate credit repair is based on a number of factors. Every person’s credit file is unique to them and so should the cost of their individualized credit repair action plan. The credit repair cost will vary based on the company and the credit repair program available. The Phenix Group does not do up front pricing for our credit support, nor should you settle for any credit repair specialist that does charge an upfront payment fee for their credit services. We do not provide a cookie cutter credit program; therefore, we can’t give a definitive work fee until a proper analysis has been conducted and an action plan written out by a credit repair analyst. Thankfully, we offer the credit analysis and consultation free of charge, so you won’t be charged a fee upfront. Once we provide a free evaluation, we can give you an initial cost of your repair plan. When working with credit experts, you will also want to ensure that you are working with a reputable company so that you avoid payment scams.

To get started on repairing credit, you need to understand how credit works, the information on your credit reports, what makes up your credit score, and continuously monitor for report changes. If you have inaccuracies on your credit reports, you should take immediate action to rectify your credit and dispute the information on the report. 35% of your credit score is based on payment history. One of the main ways to repair credit is to immediately start and continue to make on time payments to your current credit obligations. If you have several credit cards, be sure to make each personal loan payment on time.

If you’re comparing credit repair companies, here are three important factors you should keep in mind as you do your credit repair review: Cost: How much does the company charge for its credit services? Be sure to compare apples to apples when looking at payment pricing for credit services. Some credit companies will charge per month while others may charge a one-time fee, and you might want to choose the most economical credit company you find. Some credit companies also offer customized packages of their credit services and will charge a setup fee. Services: What services does the company offer? You’ll want to look for companies that offer a wide range of services and features, including a free consultation, mobile app, accessible customer service, credit counseling, dispute resolution, financial education, and money-back guarantee. Reputation: What is the company’s reputation? Be sure to read online reviews and check the company’s rating with the Better Business Bureau (BBB). Companies with a good reputation are more likely to offer better plans to repair your bad credit and improve your reports. Choosing a reputable credit service with good online reviews will also help you avoid scams.

A repossession will stay on your credit report for up to seven years, which means that all the late payments on a loan or credit card, as well as the repossession, will show up on your credit report. The repossession itself will also lower your credit score, making it harder to get approved for loans and credit cards in the future. Fortunately, you’ll have a chance to undo the credit report damage after a repossession, as the sale of a repossessed asset is often not enough to balance the amount you owe to a lender. In this case, your lender could possibly negotiate a new repayment plan with you so you can pay off the balance and restore your credit. If you’re able to make all your payments on time and keep your account in good standing, the repossession will eventually fall off your credit report.

As we are true credit experts, we understand how to implement strategies to address accounts and build positive credit reports for our consumers. Our credit consultants give one on one, expert advice to get past credit issues and possibly improve your bad credit score. With our repair process, we provide more than the typical bureau level dispute for credit issues on your report. This includes services such as engaging original creditors, finance companies, collection agencies, and bureaus throughout our program with a goal to hold them accountable to consumer or federal laws that relate to credit reporting, collection, and consumer communication. Many credit repair companies only provide disputes to the credit bureaus or generic ‘validation letters’ to creditors. Where some credit companies will be selective on what credit score issues to address and limit it to a few accounts at a time, we are aggressively addressing everything on your report from the start of the credit repair program. We will evaluate the credit history to create the best plan for improving your personal financial situation and your score.

We are not a debt consolidation agency; we are a credit repair company. While some credit repair agencies may handle debt consolidation, our company focuses on credit services rather than debt consolidation. Paying debts off, credit cards, or other debts, on your credit report does NOT guarantee the account will then be deleted or removed from your credit history. Remember, credit and debt are two very separate things. Once we have had a chance to conduct a free credit score and credit analysis, we can start to strategically determine which accounts, if any, can be paid and negotiate how to get the debt account deleted permanently so that it doesn’t have a negative impact on your score or credit reports.

Understanding what accounts to pay largely depends on the credit goal in mind. Many different factors such as the date of last account activity, statute of limitations, type of account, cost and fees, and how the debt is calculated against debt ratios (such as your credit utilization score) and balance to limit ratios must be considered. We recommend requesting a free credit analysis to determine the best course of action to improve your score. Our credit repair specialists will create recommended credit repair actions that can help you get your score back on track with your personal financial goals.

Credit Karma software uses The Vantage 3.0 scoring model for their credit reports as most credit bureaus utilize traditional FICO Score tools specific to the type of financing. While the software can give you some information about your financial situation, the credit score used by companies, credit bureaus, and financial institutions is calculated differently. Credit bureaus have very specific formulas for calculating credit scores.

Although the majority of our credit clients are referred to our services by Real Estate Agents and Loan Originators, we are deeply connected to a vast network of companies and professionals all across the country. We would be happy to make the connection with our partners for you. Typically, any business we refer you to will be our Preferred Partner and have been vetted by us. We trust them to provide the highest level of service complimentary to the service The Phenix Group provides to our consumers.

Simply put, credit repair companies repair credit; although, a good credit repair company will provide more than just that. Things like credit education, advice on opening and closing personal credit accounts, information on loans, coaching on how to attain and maintain great credit are benefits of working with the best credit repair organizations. You can use credit repair organizations that offer free credit report evaluations that can help you get back on track with your credit report goals.

Credit repair is something all consumers can do themselves. However, in our experience, most individuals who are not savvy with consumer and credit laws typically do not have much success in their endeavors to repair their personal credit. It is tedious, time consuming, confusing, and overall frustrating to repair your credit. This is where a credit repair service steps up to help. We have had to help numerous individuals repair damage they caused by disputing their own credit woes with the credit bureau. Engaging with a legitimate credit repair company will save you time and the headache of dealing with bad credit on your own. Working with a professional credit service can boost your confidence and help fix your credit score.

The fastest way to repair credit is to hire a credit professional who gives you a custom action plan for your current credit situation. Depending on your current score and credit circumstances, fixing your credit this is still a lengthy process due to the allotted response times given under law to creditors and credit companies. The most important factors in improving your score and credit reports are maintaining on time payments with all your current credit obligations, such as credit cards, loans, and other credit items, and not allowing any new collections to report on your credit file.

There are a few things you can do to make sure your credit stays in good shape after it’s been repaired. First, be sure to make all your account and loan payments on time–this includes any new loans, credit cards, or lines of credit you take out after your credit has been repaired. Most systems now offer automatic card or loan payments or you can set up alerts each month to remind you. Second, keep your credit card balances low–use less than 30% (ideally 10%) of your credit limit on any credit cards you have. Third, don’t close old credit cards. Even if you don’t use the credit card, having a longer credit history can help boost your score and improve your credit report card. Finally, check your credit report regularly to make sure there are no payment or account errors that you need to dispute; you can get a free copy of your credit report from each of the three major credit bureaus every year. The free report from the credit bureaus is a credit repair guide to help you evaluate where you are at and identify areas of improvement. Of course, these are all things you should do from the start to avoid a low credit score, but if your score has already been damaged by poor financial practices, it’s important to follow these credit tips even more diligently. You can also get a free credit consultation and advice from credit services on how to better manage your money and maintain a good credit score.