California is not only the most populated state in the U.S., with nearly 39 million residents, but its economy is a beacon of strength and significant power for our country. Los Angeles, in particular, is a city of transplants, exploding job growth (thanks to companies like Google, Facebook, and Warner Bros), and countless days of sun-filled weather. With the average rent of a one bedroom apartment at $2,068 and median home price of nearly $800,000, it’s no wonder that footing the bill for such an expensive lifestyle has resulted in LA residents having a low average credit score of 668.

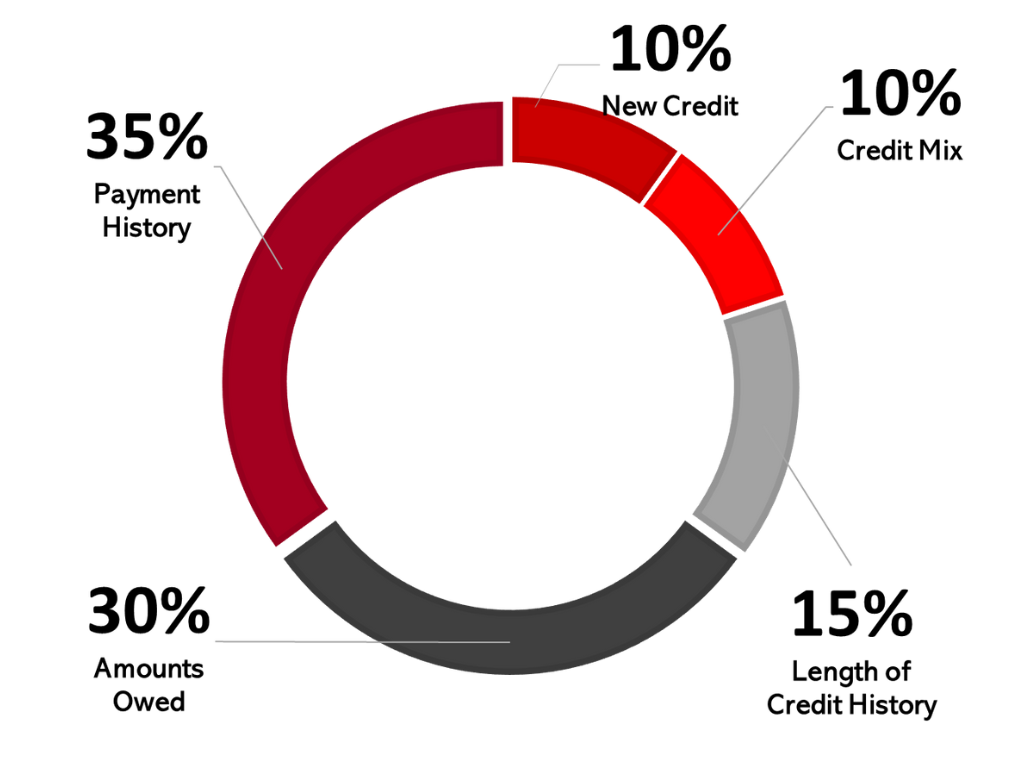

Creditors, credit card companies, and lenders use a scoring formula known as FICO® to measure the likelihood that you’ll meet contractual obligations and pay bills in full and on time. To evaluate your credit risk, the FICO® system uses the length of your credit history, debt ratio, payment history, credit mix, new credit, and accounts owed to calculate a score ranging from 300 to 850. For those slathering on sunscreen each day to protect themselves from the hot LA sun, having a poor credit score isn’t something you have to carry with you for the rest of your life. Financial freedom is possible.

How Does Credit Restoration Work In Los Angeles?

Between the luxurious beachfront Malibu homes, the eclectic Venice Boardwalk, and the glitz and glam of Rodeo Drive shopping, it’s not hard to find yourself with a maxed-out credit card and a persistent debt collector knocking at your door. Keeping up with Los Angeles living expenses, your social calendar, and the overall pricey nature of living in the City of Angels is no easy feat and we often overlook the consequences of each financial decision we make. The truth is; however, creditors and lenders monitor every purchase and finance-related choice you make to determine how reliable you are to pay back loaned money.

If you’ve filed for bankruptcy, find yourself regularly making late payments, defaulted on a loan, or have had an account charged off, it will reflect poorly on your credit score. While these are common, and sometimes unavoidable mistakes, they still greatly interfere with your financial health and will keep lenders from wanting to work with you. Even minor goof ups, such as closing an old line of credit or habitually maxing out your credit cards can cause you to inherit the label of a high credit risk.

When you have inaccuracies parading across your credit report, employing a credit repair service will help eliminate these errors. Whether a lender made a reporting error or there’s personal information listed incorrectly, The Phenix Group specialists and our team of attorneys will work to remove and amend these items, strengthening your credit score and ushering you towards achieving a healthier financial picture. Our analysts have mastered navigating through consumer-related rules and regulations and will act as your advocate when negotiating with creditors on your behalf.

Credit Repair Company Reviews

I have worked with a few other companies in the past and in no way received the support, or results we did with The Phenix Group

Jacquelyn Juarez

from Google

No gimmicks only results. The process is simple but you have to be committed and follow their process in order to get the best results. #ThePhenixGroup

Javier Hernandez

from Google

Phenix Group is hands down the best credit repair company for anyone looking to improve their credit to buy a home, car, etc. As a lending professional, I can attest that they are head and shoulders above other credit restoration outfits.

Sean Spacil

from Google

I followed their plan and MAN oh MAN did they Deliver! 3 months and 150 points later and I just CLOSED ON MY HOME!! BEST DECISION I EVER MADE! WORTH EVERY PENNY!

Stephen Anderson

from Google

Working with The Phenix Group was like working with family. Not only were they incredibly knowledgable, attentive, and on top of EVERYTHING, they were kind, sincere, and truly cared about our goals and our future happiness!

Zaena Cherif

from Google

What Credit Repair Services We Offer In Los Angeles

Home Ownership

Home Ownership-Our flagship service! All of our credit repair analysts are well-versed in the mortgage and underwriting requirements. We will work with you (the buyer), your lender, and the real estate professional involved in your purchase to ensure we are able to hit your closing date deadline with efficiency. If you are a first time homebuyer and want help with finding a reputable lender or realtor who will work for you during your home buying process, TPG has a network of trusted preferred mortgage professionals we can refer to you. We take an all-inclusive approach. Our process includes the creidt reporting agencies (CRA’s), creditors and third-party collection agencies who have reported erroneous information on your credit report. Going after the inaccurate information on all platforms helps create a permanent result. The Phenix Group will work diligently on your behalf to help raise your credit score. We’ve helped thousands of people in your position, and we can do the same for you. Contact us today for a no cost credit consultation.

Read More

Business Financing

There are a few options to secure a business loan. Obtaining the funds is the ultimate goal; however, securing those funds at a favorable interest rate can be equally impactful. The most important factor considered in securing any business loan is your overall credit rating. The Phenix Group credit repair company can help restore your credit scores in the shortest possible time, so you can secure your business financing. TPG, a reputable credit repair company, has built relationships with a plethora of business finance lenders to help with all of your business financing needs. Schedule a free credit analysis today to learn more about the credit plans available to you and your business.

Read More

Home/Auto Refinancing

Sometimes we are forced into a loan with significantly higher interest rates. Those rates do not have to be a life sentence, fortunately. Home and Auto refinancing are often able to be obtained after successful completion of our credit repair program. Allowing you to not only obtain lower interest rates but to ultimately substantially lower your debt to income ratio (DTI) in the process. Schedule your free credit analysis today to see how we can help you.

Read More

Just Because

It’s no secret, credit repair as it relates to home buying is our jam; but that doesn’t mean we can’t help the everyday consumer improve their credit score, too. Even if you may not currently be in any other category listed above, your credit is no less important. Honestly, it is much less stressful to have time to prep for whatever your goal is, instead of needing help yesterday. No matter the goal, our credit repair services can help with a custom plan for an overall financial clean up, as well.

Read More

About Us and Credit Repair Los Angeles

The Phenix Group

When you partner with The Phenix Group, a legally compliant Los Angeles credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Don’t Trust Us? Trust Them!

Client Success Story

Meet our Former Client,

Vincenzo

Credit Score: 794 647

I can honestly say, I had a new pep in my step that day. I felt like a new man!

Meet Our Former Client,

Jimmy

Credit Score: 761 560

I was able to stop worrying about if we were going to get our dream home when we got the final approval! They took a ton of bricks off the top of us. We could breathe.

Los Angeles Credit Repair

Working on credit, in a City near you

The Phenix Group will collect all three of your credit reports from TransUnion, Equifax, and Experian and analyze the information to sift out errors. Did you know, if your report includes a negative item from a lender who has since gone out of business or been acquired by another company, that the claim can be disputed as unverifiable?

This is one of the many professional and ethical solutions our credit specialists use to restore your credit to good standing.