Are you getting calls from a company called Credence? If you are, you should know their full name is Credence Resource Management and they are a collections agency based out of Dallas, Texas.

Like most collectors, Credence is contacting you regarding a debt that you allegedly owe. Even though you may have never borrowed money from Credence itself, either Credence has bought your debt or been hired by a company to collect a debt on their behalf. Perhaps it’s a canceled auto pay that the company believes you owe money for.

The calls could be a case of mistaken identity, in which case, working with a legitimate credit repair company in Atlanta, Georgia might be a good idea.

What Debt Collectors Are Allowed and Not Allowed to Do

Contrary to popular belief, there are many laws surrounding the collection of debts due to a federal law known as the Federal Debt Collection Practices Act (FDCPA). This sets forth various laws as to how a debt can be collected, such as:

- Debt collectors may not call before 8:00 AM. or after 9:00 PM without your permission.

- Debt collectors may not pretend to be law enforcement or threaten you with jail or physical harm.

- Debt collectors aren’t allowed to tell anyone about your debts, except those you have expressly informed or your spouse, if you live in a community property marriage state.

- Once asked to stop, debt collectors cannot continue to call you at your place of employment.

This Is a Mistake and the Debt Isn’t Mine—What Now?

If you believe that the debt being discussed does not belong to you and the collection agency won’t take no for an answer, it might be time to seek out the services of a credit repair company to help clear your name.

How Does Credit Repair Work?

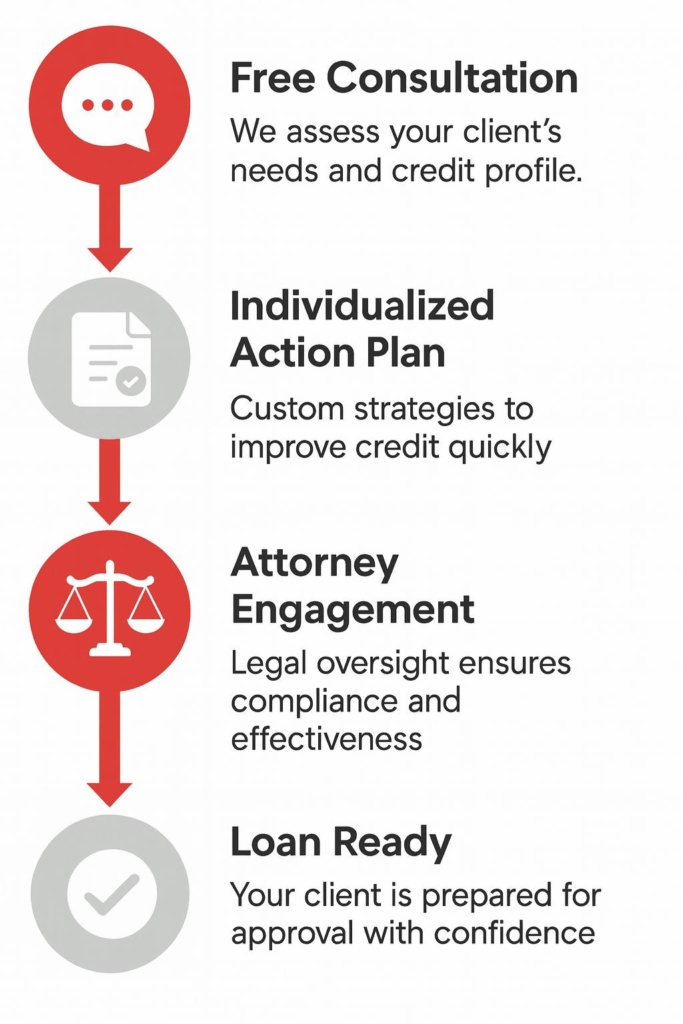

A credit repair company’s job is to assist you in getting inaccurate information removed from your credit report. They do this by communicating with the three credit reporting bureaus in the United States. These companies—Equifax, Transunion, and Experian—are holding all the cards when it comes to your credit report and score.

A single collection account showing on even one credit bureau report can ruin a perfectly good credit score, so it’s important to get this issue resolved as soon as possible. After reaching out to the credit bureaus to verify the collections account and which of the bureaus have it listed, the credit repair company will contact the financial institution or creditor the debt is owed to and file paperwork to prove the debt isn’t yours.

Once it’s been established that the debt does not belong to you, the credit repair company will send certified letters to all parties involved to assist in getting the debts removed.

What Else Can Credit Repair Do?

If you have poor credit and are interested in how Self Credit Builder works, don’t waste your time–all they do is charge you money to say nice things about you to the credit bureaus. The benefit of working with a licensed credit repair company like The Phenix Group is that we will counsel you on best practices to not only obtain a high credit score, but to keep it there.

We’ll explain the ins and outs of the entire system at hand so you can make the right decisions when it comes to your personal financial and credit future. When you consider that a single point of lower interest rates from 7% to 6% on a thirty-year $300,000 mortgage can save you over $50,000 over the life of the loan, credit repair services are a bargain.

Repairing Your Credit Today

If you keep getting calls from Credence or another collections agency, it might be time to get some help. This help comes at a cost, but when the alternative is a damaged credit score, the cost is well worth it. Contact The Phenix Group today and review your options with experts.