THE BEST SEATTLE CREDIT REPAIR COMPANY-ATTORNEY-POWERED

Seattle, Washington is known as the Coffee Capital of the World – who doesn’t love the taste and aroma of a steamy cup of joe. The Emerald City has a reputation for having dreary, rainy weather, but it actually rains less per year in Seattle than it does in Boston, New York City, and Philadelphia. With the beautiful mountain views and water nearby, Seattle makes for a pretty attractive place to live. Those living in Queen City have a laid-back style that is certainly contagious and may make you never want to leave. While residents possess and average credit score of 704, there are still many individuals struggling to keep their heads above water when it comes to their finances. And that’s where credit repair comes into the picture.

How Does Credit Restoration Work In Seattle?

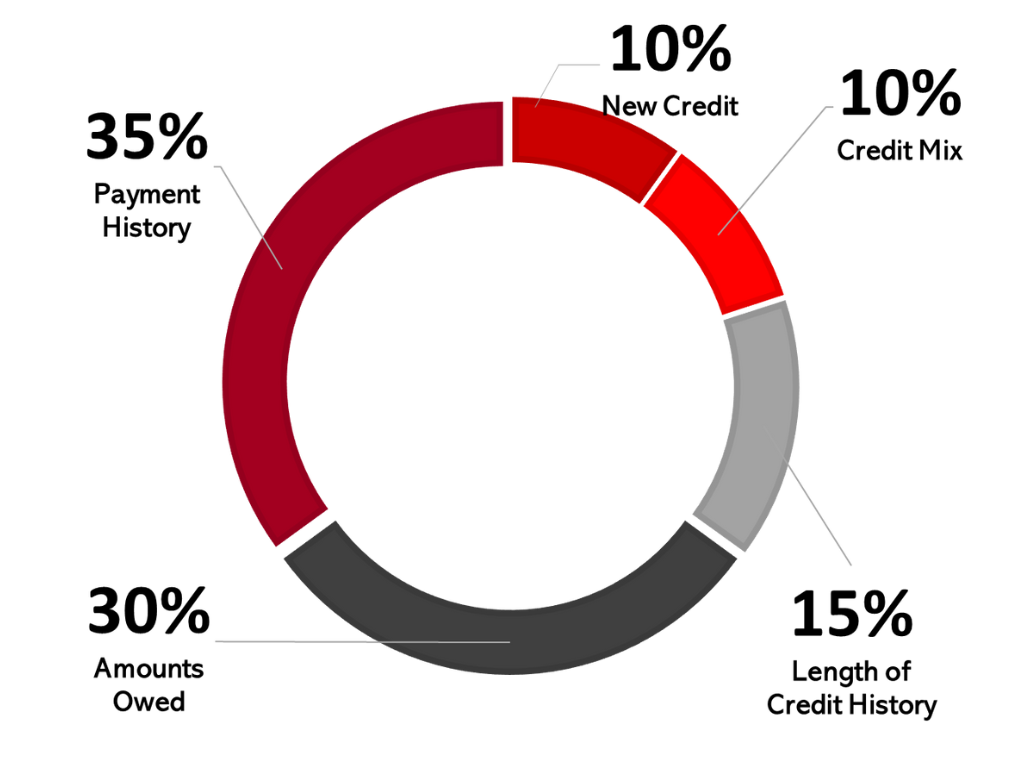

If you’re a Seattle, WA resident with a poor credit score, the reminders may be enough to make you want to pull your hair out. You’re being berated with daily reminders of how poor your credit score is every time you open up your email, apply for a loan, or see the mounting interest rates on your insurance premiums. So, how do you achieve a better credit score – one that rivals with some of Seattle’s best? First, you need to understand how your credit score is determined. Your score is calculated using the FICO® formula. Your score is determined by a number of factors, including debt ratio, payment history, the length of your credit history, outstanding balances, and new credit lines you have opened. Credit scores can range anywhere between 300 and 850. Essentially, a poor credit score smacks on a big red X on your file, and lenders and creditors will use this number to categorize you as a risky borrower. Suddenly, your interest rates will skyrocket. Thankfully, a poor credit score can be repaired.

Credit Repair Company Reviews

About Us and Credit Repair Seattle

The Phenix Group

When you partner with The Phenix Group, a legally compliant Seattle credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Seattle Credit Repair

Working on credit, in a City near you

Your friend in the mission to better credit is The Phenix Group. Working with an independent law firm, The Phenix Group has the expertise and long-standing reputation you need to repair your credit score. The Phenix Group looks to identify any inaccurate, unverifiable, or outdated information that is impacting your credit report. We request reports from the three main reporting agencies – Transunion, Experian, and Equifax in order to help remove any harmful items that are currently damaging your credit score. A poor credit score can impact your everyday life. We have seen the repercussions first-hand.

This is why we’re here for help. As a reliable credit repair specialist, The Phenix Group will design a personalized strategy to help bump up your credit score. It’s our mission to help dig you out of that black hole surrounding a poor credit score so that you can get on with your life and be able to move forward in a fiscally responsible way.