CREDIT REPAIR SERVICES: ATTORNEY-POWERED CREDIT REPAIR EL PASO, TX

Between the 300-plus days of sunny weather and assortment of cultural and recreational offerings, El Paso, TX is a magnetic city with a diverse population of residents. From the Abraham Chavez Theatre, in all its sombrero-shaped glory, to the Hueco Rock Rodeo annual festival, the area is truly a magnificent place to call home. Economic growth has been fueled by the presence of the University of Texas, Fort Bliss, and the Texas Tech Health Sciences Center, as well as the 70+ Fortune 500 companies that have made El Paso the 4th largest manufacturing hub in North America. But amid all these exciting elements, comes one very troubling reality: El Paso residents, especially in Area Codes: 79901, 79902, 79912, 79924, 79925, 79936, 79938, are being crushed by poor credit scores, with an average score of 650. The median student loan debt of $14,715 and credit card debt of $4,935 are just two of the many hard-to-swallow factors that contribute to the regions’ bad credit scores. The FICO® scoring system yields a simple, yet powerful, three-digit number ranging from 300 to 850, and can give lenders and creditors a whole lot of insight about your financial situation. When you possess a poor credit score, it can negatively impact your purchasing power as lenders use your credit report to assess how risky it will be to conduct business with you.

How Does Credit Restoration Work In El Paso?

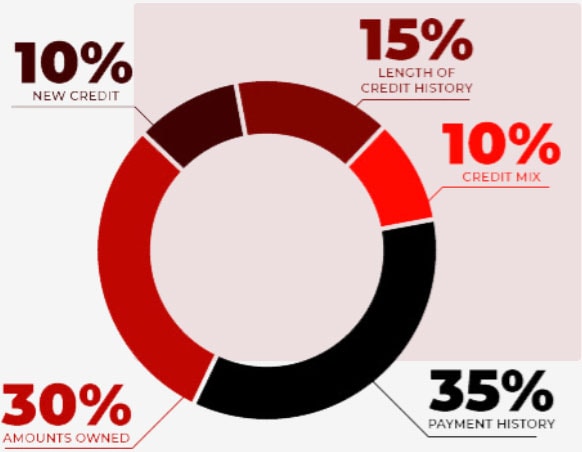

Your level of creditworthiness is measured by your credit score. Intentional or not, your financial actions can dictate to a lending institution whether you’re someone who is a good investment. Creditors view your past financial behavior, which is collected and calculated into a credit score, as a strong indicator of your future monetary actions – i.e., the likelihood of you defaulting or missing payments. Some items that cause your credit score to tumble into choppy waters include, not making payments on time, your total amount of debt (from credit cards, mortgages, judgments, etc.), the length of your credit history, the number of new accounts opened, or credit inquiries made recently, and what type of credit mix you have. The laid-back lifestyle and wealth of opportunity in El Paso can become problematic if you begin maxing out credit cards or neglecting to pay that stack of bills piled on your bedroom dresser. Bad credit can happen to anyone; especially if you must undergo an unexpected medical procedure or you’re suddenly laid off by your employer. Juggling the stress of any abrupt, unforeseen life circumstances with your family and financial responsibilities is no easy feat – and it can certainly lead to defaulting on a loan or filing for bankruptcy.

Credit Repair Company Reviews

About Us and Credit Repair El Paso

The Phenix Group

The Phenix Group is a legally compliant El Paso credit repair company that recognizes how demoralizing it can be to have a poor credit score interrupt your life. If there’s anything we love more than El Paso’s vibrant Mexican heritage and flavorful cuisine, it’s the fulfillment we receive each time we help restore someone’s financial well-being by improving their bad credit score. Addressing our customer’s credit challenges and watching them make life-changing transformations as they finally obtain that condo or car they’ve been fighting for; is the reason we treat each person with the level of care and respect they deserve. Landlords, insurance companies, banks, credit card companies, and government organizations will evaluate your credit score before approving or denying your application. With a bad score, you’ll find it difficult to purchase a new home or get a reasonable insurance quote – and even if you are approved, you’ll face extremely high interest and premium rates. But there’s good news for El Paso, TX residents; you do not need to be defined by your bad credit forever. With The Phenix Group’s credit repair, we can build personalized solutions, from quick fixes to complete rebuilds, to restore your financial standing and improve your credit score.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

El Paso Credit Repair

Working on credit, in a City near you

Regardless of the choices that ushered you to your bad credit score, The Phenix Group is equipped with a group of analysts, who specialize in dissecting every facet of your financial picture to remove and correct errors on your credit report.

Together with an independent law firm, The Phenix Group gives you the respect and care you deserve, creating a customized credit repair solution that tackles your unique challenges in the most timely and efficient manner possible. Our industry experience has given us the knowledge necessary to expertly negotiate with lenders to help boost your credit score and realize a healthy financial lifestyle.

Learn more about how to get an apartment with bad credit.