ATTORNEY-POWERED CREDIT REPAIR PITTSBURGH

Pittsburgh, Pennsylvania has a lot going for it. A rich culture, good schools, and professional sports teams are just some of its qualities drawing people into the city.

It’s a convenient yet exciting place to live, where families can enjoy a mix of attractions, restaurants, and parks, on top of the 446 bridges that it owes its nicknames ‘city of bridges’ and ‘steel city’ to. Pittsburgh offers a semi-urban feel without the hustle and bustle that comes with other big cities.

That said, the cost of living, though affordable for a place like this, is still high–4% above the national average, to be specific. This bodes well for most, considering that the average credit score in the city is high at 714.

Of course, that’s not the case for all residents, with many still suffering from low credit scores due to lower salaries (the average salary in Pittsburgh is lower than the national average) and unemployment.

How Does Credit Restoration Work In Pittsburgh?

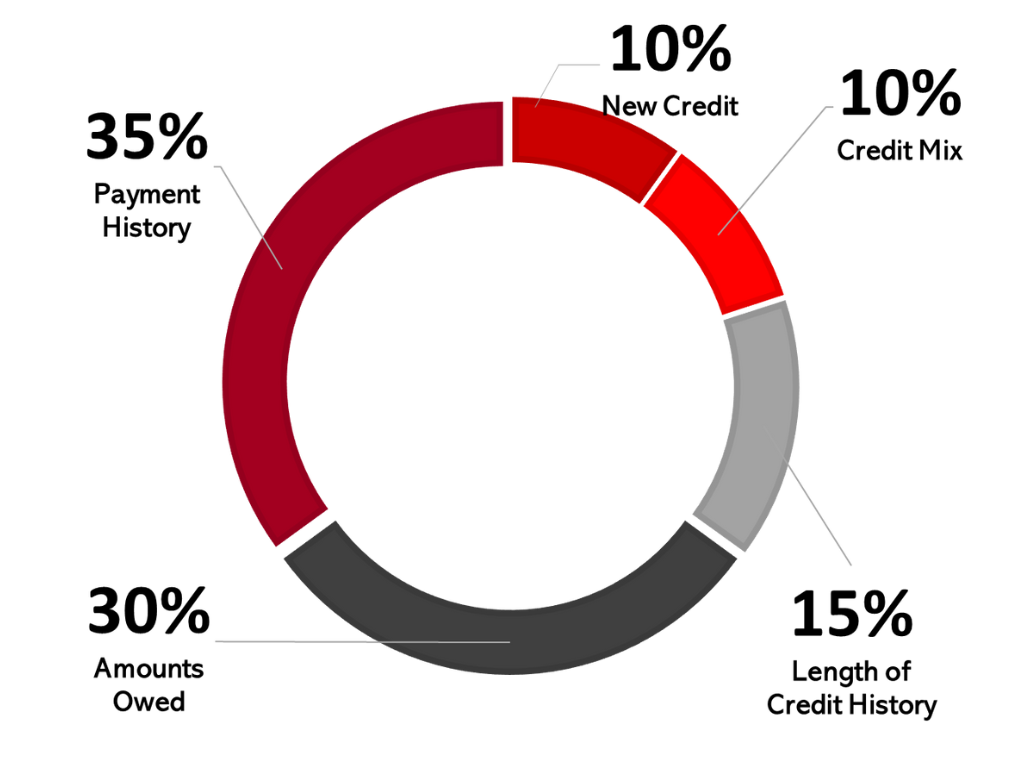

Credit restoration is the process of fixing any discrepancies in a person’s credit report to improve their credit. This involves several steps, starting with reviewing the credit report to check for errors such as duplicate accounts, incorrect inquiries, inaccurate details, and other mistakes that may be negatively affecting your credit.

Once these errors have been identified, the credit repair company gathers evidence to dispute them (e.g. proof that you’ve made payments, receipts showing correct amounts, etc.) and then challenges them with the credit bureau, generally successful in removing collections from credit report. They request a review of the disputed information, which the credit bureau must then correct or remove unless verified. The credit repair company may also be tasked to handle negotiations with creditors if needed.

Credit restoration also means getting educated on better financial health. Good credit companies teach their clients how to build and maintain responsible credit habits, tailoring their advice to the client’s needs for more effective results. Everything that a reputable credit repair company does will always be based on credit laws and best practices, so you can trust that they know how to work with your situation in the most efficient way.

Credit Repair Company Reviews

About Us and Credit Repair Pittsburgh

The Phenix Group

When you partner with The Phenix Group, a legally compliant Pittsburgh credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Pittsburgh Credit Repair

Restoring Your Credit in Pittsburgh

Repairing your credit score is a tedious and time-consuming task. While you can do parts of it on your own, the work can be complicated and troublesome, especially if you’re not knowledgeable about the practices and processes that come with credit law and bureaucracy.

Hiring a reliable credit repair company like The Phenix Group is the best solution. We can help with credit restoration by assessing and disputing inaccurate and negative marks that are damaging your credit score, all while adhering to relevant credit laws and following best credit repair practices.

We can also provide support and guidance to help you become more financially responsible–we’ll teach you the best ways to save and budget in a context that’s achievable and sustainable for you. Reach out to The Phenix Group today!