ATTORNEY-POWERED CREDIT REPAIR NEW YORK CITY

New York City is a melting pot of diversity, with dozens of citizens hailing from other states and countries. The fast-paced lifestyle, 24-hour hustle, and vibrant culture of the Big Apple offers a variety of attractive benefits for young professionals and families of all backgrounds and sizes. Interested in a booming economy? Evening at a Broadway show? Grand Central Station in your backyard? There’s virtually every store or shop you need within a three-block radius of every living space, making for a conveniently addictive lifestyle for many residents.

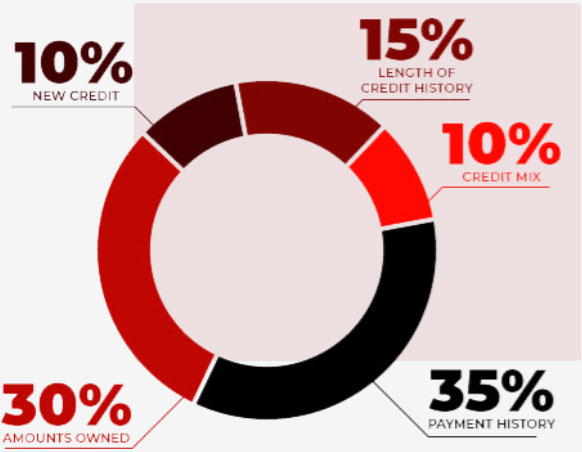

Despite the extremely low 4% unemployment rate in NYC, residents are still struggling with high credit card debt and an average credit score of 697. For those New Yorkers who are battling financial instability, there’s no way to truly enjoy all the Empire City has to offer. This three-digit score is determined by a formula devised by a popular system known as FICO®. In order to calculate your credit score, FICO® analyzes your outstanding balances, payment history, debt ratio, types of credit lines you have, length of your credit history, and any new credit lines you’ve established.

The problem with having a low credit score is that creditors and lenders will consider you a high-risk borrower, making it extremely difficult to purchase a new car or buy a new home. When your purchasing power is stripped away, it can feel like a dark cloud has positioned itself over your head, following you wherever you go. While having a poor credit score will have a negative impact on your life, it’s not something that has to define you forever, be sure that you are up to date on the New York debt collection laws. The Phenix Group credit repair New York, has designed individualized credit repair solutions to help New York residents rebuild a healthy financial picture and improve their credit scores in a timely manner.

How Does Credit Restoration Work In New York City?

At the Phenix Group, our attorney-engaged credit repair services are tailored to fit each of our client’s unique challenges and goals. Our credit specialists will gather and assess your consumer credit records to build a solution specific to the items found on your reports. By pinpointing inaccurate, outdated, or unverifiable information, including incorrect personal details or lender reporting errors, our analysts can challenge and remove these errors to boost your credit score. There are many instances where a report may contain a negative record that originated from a lender that is no longer in business. When this occurs, the reported information can no longer be verified, which is why we’d work to have it removed.

The Phenix Group’s credit specialists will negotiate on your behalf, calling upon consumer protection laws and our long-standing industry experience to help rebuild your financial standing and free yourself from the restraints of a poor credit score. It may not seem like a loan or credit card could possibly impact getting a new job or home, but it means everything. Landlords will see you as a risky renter and one who is potentially unable to pay your rent every month if your report shows payment delinquencies. The good news is, you don’t have to run away from debt collectors, experience revoked job offers and denied applications, or pay high interest rates once you work with The Phenix Group.

Credit Repair Company Reviews

About Us and Credit Repair New York City

The Phenix Group

When you partner with The Phenix Group, a legally compliant New York City credit repair company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

New York City Credit Repair

Working on credit, in a City near you

Between our professional lives, taking care of our homes, and maintaining a social calendar, life can feel like a hectic balancing act. Juggling everything life throws at us can easily disrupt your financial stability. Unforeseen events, such as an employment loss or a mountain of hospital bills can seemingly escalate overnight, leading to a default on a loan or a charge off due to unpaid credit card bills. A new purchase can capture our attention – who doesn’t want to show off their shiny new ride or brand-new furniture they bought for their apartment? However, with every application approval or swipe of your credit card, comes contractual obligations and the need to be fiscally responsible. Everyone can make a mistake or face an unexpected hiccup that causes their credit score to plummet. When your ability to repay a loan or pay your bills on time is wrapped up into a number that determines your creditworthiness, a bad score can mean lenders refuse to do business with you.

What may seem like an insignificant blunder, like missing a few car payments, can result in higher insurance premiums, denied mortgage applications, and extra fees on your utility bills. With more and more dollars being tacked on, it’ll only dig you further into a black hole of debt. Achieving your goals means elevating your credit score and getting your financials back in order. The Phenix Group’s credit restoration services are built on the belief that you shouldn’t have to carry a few financial mistakes along with you year after year, becoming a powerfully defining aspect of your life. Whether you need help with a loan consolidation, debt settlement, bankruptcy, or dispute code removal, we work as your advocate, rectifying poor credit scores and ensuring you can enjoy all the Big Apple has to offer.