ATTORNEY-POWERED CREDIT REPAIR ST. LOUIS

Beautiful architecture, historic metro areas, and tight-knit communities make the Gateway to the West, St. Louis, an attractive place to live. With great employment opportunities, sprawling parks, and top-notch school districts, St. Louis is a thriving and charming city that has become home for many. If you find yourself wondering how you stack up financially in comparison to your neighbors and coworkers, St. Louis holds an average credit score of 655. When the city is dissected and analyzed by zip code, there are some areas holding a median score of 532. Ouch. Missouri as a whole is the 18th worst state for student debt, with the average student clocking in at around $29,183. Having to shoulder the burden of a poor credit score and financial hardship can really hinder your ability to live life to the fullest.

How Does Credit Restoration Work In St. Louis?

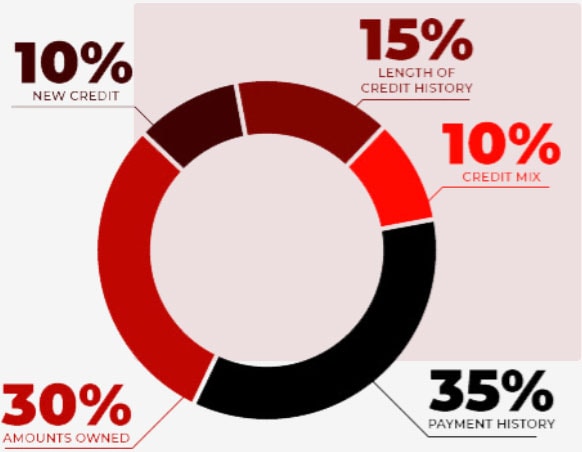

Your finances are a mess and Credit Karma is sending daily emails to rub your poor credit score in your face. So, how exactly did you acquire this three-digit number? Credit scores are determined using the FICO® formula. Your full financial picture, including the types of credit you have, debt ratio, payment history, the length of your credit history, outstanding balances, and new credit lines you may have recently opened are all factors used to calculate your score. Ranging from 300 to 850, having poor credit can weaken your purchasing power and disrupt your everyday life. This is because lenders and creditors will put you into the “risky” borrower category, causing your interest rates to skyrocket and your loan applications to be denied altogether. The good news is having bad credit isn’t permanent if handled correctly. For Mound City residents, unemployment, unexpected expenses, and managing loan payments can lead to payments slipping through the cracks and a higher debt to income ratio. With a low credit score, comes a number of unpleasant barriers and hardships, like high insurance premiums, application denials, extra fees, and the inability to procure a loan. Instead of grabbing a bucket of ice cream and crying in the closet as a debt collector pounds on your door, you needed to address your poor credit to avoid financial instability. Our St. Louis credit repair services are designed to restore your credit standing so you can enjoy everything the Lion of the Valley has to offer.

Credit Repair Company Reviews

About Us and Credit Repair St. Louis

The Phenix Group

When you partner with The Phenix Group, a legally compliant St. Louis credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

St. Louis Credit Repair

Working on credit, in a City near you

Here at The Phenix Group, we work with an independent law firm and team of credit specialists to provide high-quality St. Louis credit repair. We work to identify inaccurate, outdated, or unverifiable information on your credit report, as these items negatively impact your credit score. By requesting reports from Transunion, Experian, and Equifax – the three main reporting agencies – our team can work diligently to remove items that are harming your credit standing. We know how disruptive a poor credit score can be.

As credit repair St. Louis specialists, The Phenix Group will design a personalized strategy to help you revive your financial health and improve your credit standing. From loan consolidations to debt settlements, our mission is to help St. Louis residents overcome financial struggles.