ATTORNEY-POWERED CREDIT REPAIR SAN FRANCISCO

From the Golden Gate Bridge to its world-renowned tech hub, San Francisco, CA is a city of innovation and extremes. While many enjoy career opportunities and cutting-edge amenities, the cost of living remains among the highest in the nation, pushing some residents into debt and poor credit standing.

Our San Francisco credit repair team at The Phenix Group uses a legal, strategic approach to improve your credit profile. We dispute inaccurate entries, guide you through score recovery, and help you qualify for better financial products. Discover the benefits of credit repair in one of the nation’s most dynamic cities.

How Does Credit Restoration Work In San Francisco?

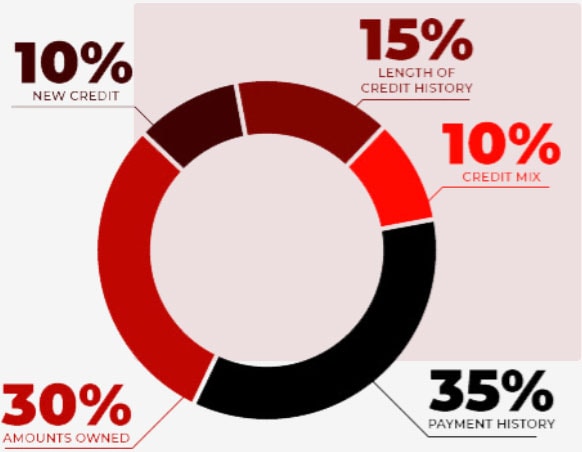

When you partner with The Phenix Group, a legally compliant credit repair company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your credit report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit repair services will give you the tools needed to set up your financial future for success.

Credit Repair Company Reviews

About Us and Credit Repair San Francisco

The Phenix Group

When you partner with The Phenix Group, a legally compliant San Francisco credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

San Francisco Credit Repair

Working on credit, in a City near you

From repossessions and foreclosures to debt settlement and credit coaching, The Phenix Group believes our credit repair solutions provide our clients with a second chance to claim back the lifestyle they thought had disappeared for good. Not only are we a legally compliant San Francisco credit repair service, but we find our work incredibly fulfilling, making life-changing improvements to your credit score while reversing your overall financial instability.

Your past financial mistakes don’t have to dictate how you live your life. There is hope for your credit score with the help of credit repair in San Francisco, TX. Your desired lifestyle is achievable through our personalized and transformational credit solutions. Say hello to that gorgeous new home you’ve always wanted!