CREDIT REPAIR SERVICES: ATTORNEY-POWERED CREDIT REPAIR LOS ANGELES, CA

As one of the world’s most iconic cities, Los Angeles, CA offers everything—from Hollywood glitz and Pacific Coast views to global cuisine and nonstop cultural events. But while LA is full of opportunity, it’s also one of the most expensive cities to live in, and many residents carry high levels of debt and below-average credit scores.

The Phenix Group offers credit repair in Los Angeles with a trusted, attorney-led process. We dispute errors, negotiate with creditors, and provide personalized strategies to boost your score. Whether you’re in West LA, Downtown, or the Valley, we can help you clean up your credit report and get back on track.

How Does Credit Restoration Work In Los Angeles?

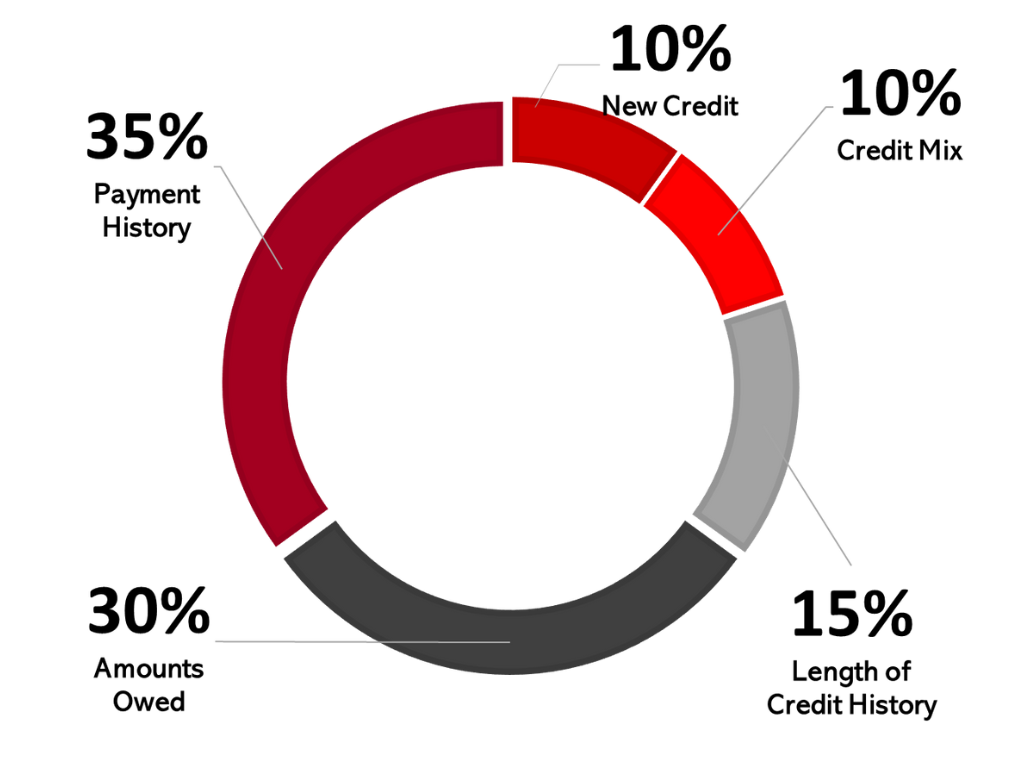

Between the luxurious beachfront Malibu homes, the eclectic Venice Boardwalk, and the glitz and glam of Rodeo Drive shopping, it’s not hard to find yourself with a maxed-out credit card and a persistent debt collector knocking at your door. Keeping up with Los Angeles living expenses, your social calendar, and the overall pricey nature of living in the City of Angels is no easy feat and we often overlook the consequences of each financial decision we make. The truth is; however, creditors and lenders monitor every purchase and finance-related choice you make to determine how reliable you are to pay back loaned money.

If you’ve filed for bankruptcy, find yourself regularly making late payments, defaulted on a loan, or have had an account charged off, it will reflect poorly on your credit score. While these are common, and sometimes unavoidable mistakes, they still greatly interfere with your financial health and will keep lenders from wanting to work with you. Even minor goof ups, such as closing an old line of credit or habitually maxing out your credit cards can cause you to inherit the label of a high credit risk.

When you have inaccuracies parading across your credit report, employing a credit repair service will help eliminate these errors. Whether a lender made a reporting error or there’s personal information listed incorrectly, The Phenix Group specialists and our team of attorneys will work to remove and amend these items, strengthening your credit score and ushering you towards achieving a healthier financial picture. Our analysts have mastered navigating through consumer-related rules and regulations and will act as your advocate when negotiating with creditors on your behalf.

Credit Repair Company Reviews

About Us and Credit Repair Los Angeles

The Phenix Group

When you partner with The Phenix Group, a legally compliant Los Angeles credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Los Angeles Credit Repair

Working on credit, in a City near you

The Phenix Group will collect all three of your credit reports from TransUnion, Equifax, and Experian and analyze the information to sift out errors. Did you know, if your report includes a negative item from a lender who has since gone out of business or been acquired by another company, that the claim can be disputed as unverifiable?

This is one of the many professional and ethical solutions our credit specialists use to restore your credit to good standing.