ATTORNEY-POWERED CREDIT REPAIR OKLAHOMA CITY

While Oklahoma City, Oklahoma has become more of a metropolitan area than ever before, The City still maintains its old Western charm. Cowboy history, rodeos, festivals, and horse shows are still on display for both tourists and residents of OKC. The City still holds the largest stocker-feeder cattle market, despite the ever-expanding restaurant and entertainment scenes. OKC used to be home to a calmer kind of group, but with the influx of younger people populating Oklahoma City, it’s becoming a much livelier place to live. Despite OKC having a bit of a revitalization period, the average credit score for the city is 646. With a score like this, OKC residents could certainly use some credit repair.

How Does Credit Restoration Work In Oklahoma City?

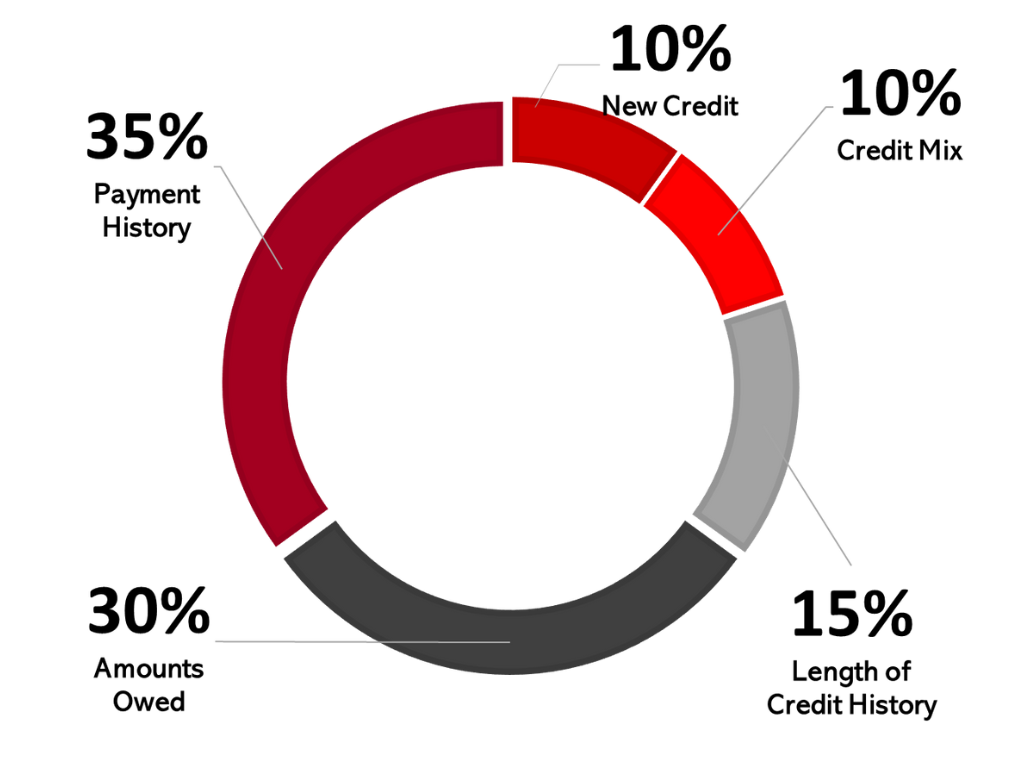

Credit scores can range anywhere between 300 and 850. You’ve always heard of good and bad credit scores, but does anyone really know how that three-digit number is determined? It’s calculated by a scoring system known as FICO®. Creditors and lenders use FICO® to evaluate your creditworthiness and whether or not you qualify for a loan. FICO® factors in your credit and payment history, debt ratio, new credit lines opened, and accounts that have unpaid balances. Increasing your credit score may feel like an uphill battle but decreasing your credit score can happen almost instantaneously. Just a few missed payments and suddenly your credit score is taking a nosedive that you simply cannot afford.

Credit Repair Company Reviews

About Us and Credit Repair Oklahoma City

The Phenix Group

When you partner with The Phenix Group, a legally compliant Oklahoma City credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Oklahoma City Credit Repair

Working on credit, in a City near you

A poor credit score is, unfortunately, damaging to your overall financial picture. Increased insurance premiums and elevated interest on your credit cards make it more difficult than ever to pay back borrowed funds. Living in Oklahoma City may feel like you’ve just hit the jackpot, but when bad credit exists, you feel as if you’re living in no man’s land. Here at The Phenix Group, we check your information against Experian, Equifax, and TransUnion. From these reports, we will ensure that any inaccuracies or reporting errors are addressed. The specialists at The Phenix Group work tirelessly to analyze information, ensuring that anything that will damage your credit score is removed. Credit repair is incredibly important to us and it’s simply what we’re great at.

There is so much to gain from investing in your financial health and seeking out reputable credit repair specialists, like those at The Phenix Group. With a long history of repairing credit scores for the residents of OKC, The Phenix Group has the expertise to really aid in your credit repair journey. You don’t want to be denied for a loan simply because you have bad credit. You know that you could pay back what is required of you if it weren’t for the high-interest rates and extra fees stacked onto your monthly bills. How is anyone expected to dig themselves out of that hole? You don’t need to be chained to your low credit score forever – The Phenix Group is here to give you back your freedom.