ATTORNEY-POWERED CREDIT REPAIR BALTIMORE

Baltimore, Maryland may be known as the Greatest City in America, but the attraction to Charm City goes deeper than an appealing name. The Baltimore metropolitan area consists of 2.8 million people and has maintained its small-town feel despite its flourishing population. Otherwise known as Clipper City, Baltimore is home to a slew of tasty restaurants, a thriving nightlife, and a diverse community. Despite having numerous historical landmarks to enjoy, the unemployment rate is sitting at 4.2% and residents possess an average credit score of 666. With those numbers, credit repair is certainly needed for the city of Baltimore, Maryland.

How Does Credit Restoration Work In Baltimore?

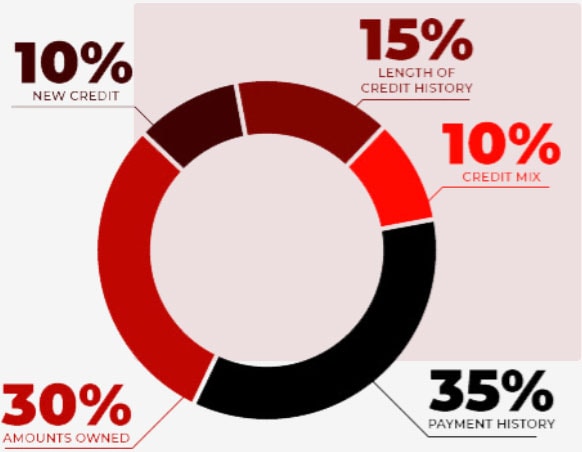

Despite everyone possessing a credit score, many individuals are unfamiliar with how their score is calculated. Creditors and lenders use a scoring system known as FICO to evaluate your creditworthiness. In other words, they are looking to determine whether or not you’re a risky borrower – AKA the likelihood that you’ll make payments against borrowed funds on time. Your credit history is considered, as well as payment history, the level of debt you have, how many accounts you owe money on, and a number of other factors. Sporting a low credit score can be disruptive to your everyday life. That’s why people often seek the help of a professional and reputable credit repair service. By improving your credit, you’ll be able to secure a loan for a new house, buy a car, and achieve the goals you’ve set for yourself.

It should be noted, though; that a poor credit score does not reflect poorly on someone – it doesn’t mean they’re irresponsible. Anyone can reverse their credit score. Those who do have a high credit score can be hit with medical bills and unforeseen roadblocks, which suddenly cause their credit score to plummet. The good news? Living in the Greatest City in America means you have access to credit repair solutions that’ll help improve your financial picture. That is what our repair services are for – to serve as a resource to combat all that credit-related stress and help you live the lifestyle you deserve.

Credit Repair Company Reviews

About Us and Credit Repair Baltimore

The Phenix Group

When you partner with The Phenix Group, a legally compliant Baltimore credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Baltimore Credit Repair

Working on credit, in a City near you

A holiday approaches and you suddenly find yourself swiping your credit cards left and right. As a tower of bills arrives in your mailbox, you begin struggling to make the minimum payments due on your credit cards each month. What’s more, the interest charges you incur by missing payments makes it virtually impossible to catch up financially. What happens when you’re living in Clipper City and suddenly you’ve lost your job and you need to rely on credit cards? Or even a loan? It only takes a few missteps to experience hardship, but through credit repair, you can begin improving your score and incorporating strategies to boost your financial health. A reputable company is what you need in order to help you repair your credit when living in Charm City.

The Phenix Group, along with an independent law firm, work on your behalf to address poor credit. With years of service and a portfolio of happy customers, The Phenix Group can help you become fiscally responsible and dig yourself out from under that poor credit score weighing you down. When you invest in The Phenix Group, you are partnering with a legally compliant Baltimore credit repair company. We are committed to providing solutions for individuals struggling to raise their credit scores. It’s what we do on a daily basis, and we can do it for you.