ATTORNEY-POWERED CREDIT REPAIR BATON ROUGE

As Louisiana’s capital, Baton Rouge is a powerhouse of government, education, and industry. With institutions like LSU, a vibrant music and arts culture, and a growing downtown, the city offers a unique blend of Southern tradition and modern energy. But despite its strengths, many Baton Rouge residents face financial hardships—from student loan debt to high-interest credit cards—that negatively impact credit scores.

At The Phenix Group, we offer credit repair services in Baton Rouge, LA that go beyond the basics. Our attorney-audited approach identifies harmful errors, outdated accounts, or inaccurate credit entries and disputes them directly with creditors and credit bureaus. Whether you’re preparing to buy a home, apply for financing, or simply want to rebuild your credit, our team helps you take control with a customized plan and legal expertise.

📞 Call today for your free credit consultation and start your journey toward financial freedom with trusted Baton Rouge credit repair professionals.

How Does Credit Restoration Work In Baton Rouge?

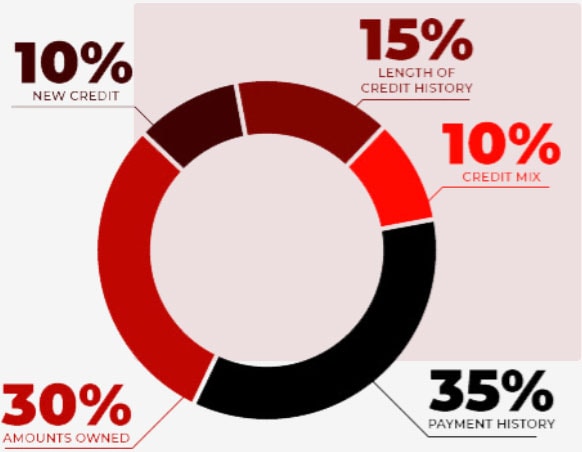

Credit scores range from 300 to 850. Your credit score is calculated using a system known as FICO®. Creditors and lenders will look at your credit score to assess your financial health and determine your likelihood of repaying borrowed funds. A bad score can really put a damper on your everyday life. Your insurance premiums will increase, you’ll suffer from high-interest rates, additional fees will be caked onto your money bills, and be prepared for loan applications to be denied. Luckily, there are ways to achieve credit repair. Repairing your credit is feasible when you have reputable credit repair specialists on your side. That is what The Phenix Group is here for. To rake through your information and determine how to best boost your credit score.

Baton Rouge may have the New Orleans charm without the 24/7 Mardi Gras, but it’s far from paradise on Earth. Meaning, bad things can happen in an instant and suddenly, your credit score is lower than you ever imagined. Missed payments can greatly impact your credit score. With so many residents of Baton Rouge suffering from poor credit, the need to identify effective credit repair solutions is imperative. With a higher credit score, you’ll be able to reduce your fees, your credit interest, and be approved to purchase a car or a house. It helps to have someone on your side and that is what The Phenix Group is here for.

Credit Repair Company Reviews

About Us and Credit Repair Baton Rouge

The Phenix Group

When you partner with The Phenix Group, a legally compliant Baton Rouge credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Baton Rouge Credit Repair

Working on credit, in a City near you

Everyone misses a credit card payment from time to time. It’s when this becomes a reoccurring habit that your credit score begins to plummet into unhealthy waters. Missing mortgage payments or filing for bankruptcy will give you that undesirable score that will have lenders and creditors deeming you as a “high-risk” borrower. Possessing an unstable financial picture can prove to be a large roadblock in your life, but it doesn’t need to remain that way. The Red Stick is rich in culture and should be enjoyed every day without having to worry about your credit score. That is why The Phenix Group should be your next phone call.

You need someone in your corner while looking to repair your credit. Think of the credit specialists at The Phenix Group as the perfect partner to tag in. With a group of experienced repair specialists, the Phenix Group teams up with a reliable law firm to assess every option available, so we can start implementing solutions to raise your score.