ATTORNEY-POWERED CREDIT REPAIR NEW ORLEANS

New Orleans, LA is world-famous for its culture, cuisine, and community—from Bourbon Street and the French Quarter to Jazz Fest and Mardi Gras. But behind the vibrant tourism economy, many NOLA residents are dealing with significant debt, credit score issues, and limited access to affordable financing.

At The Phenix Group, we provide credit repair in New Orleans that’s as powerful as it is personal. Our attorney-backed process starts with a detailed audit of your credit file and a strategic plan to remove outdated, unverifiable, or inaccurate items. Whether you’re trying to rebuild after financial hardship, qualify for a home in Uptown, or refinance in Mid-City, we’re here to help.

📞 Call today for your free credit evaluation and take the first step toward financial freedom in the Crescent City.

How Does Credit Restoration Work In New Orleans?

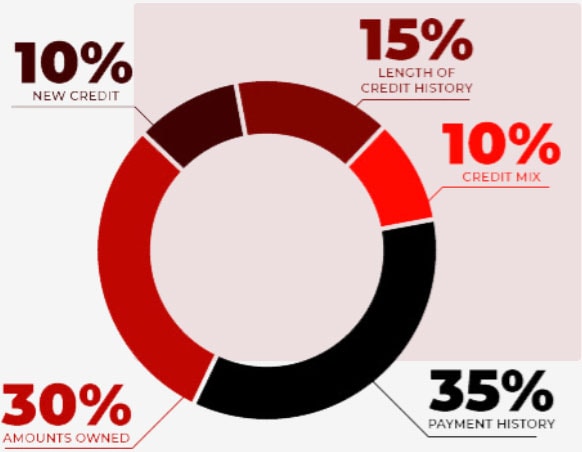

Creditors and lenders want to measure the likelihood that you’ll pay back borrowed funds. They call this your creditworthiness. To calculate whether or not you’re a “risky” borrower, the FICO® scoring system is used to evaluate your financial health. This produces your credit score, which can range from 300 to 850. To determine your score, a multitude of factors are taken into consideration, such as your payment history, debt ratio, length of credit history, new credit lines you’ve recently opened, the type of credit mix you have, and any accounts with unpaid balances on them. The important thing to remember is many people struggle with their finances. Anything from an unanticipated expense to a few missed payments can cause you to wind up with a poor credit score. The good news is that’s what New Orleans credit repair is for. When you have a bad credit score, it comes with some not-so-pretty implications. For instance, you’re vulnerable to high interest rates on your credit cards or loans, increased insurance premiums, additional fees tacked onto your utility bills, and even denied loan applications. For our New Orleans credit repair services, we request a copy of your credit report from Equifax, Experian, and TransUnion – the three main reporting agencies. Wondering why we pull reports from all three? Believe it or not, each of your credit reports may be capturing different information. Our mission at The Phenix Group is to ensure we identify and remove all errors from these reports, so they are no longer damaging your credit score. The credit analysts at The Phenix Group work on your behalf to correct outdated information, while educating you on your rights as a consumer, because we truly care about helping you live a life free of poor credit.

Credit Repair Company Reviews

About Us and Credit Repair New Orleans

The Phenix Group

When you partner with The Phenix Group, a legally compliant New Orleans credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

New Orleans Credit Repair

Working on credit, in a City near you

For those living in The Big Easy, The Phenix Group will help you through every step of the credit repair process. The last thing we want is to see your new job offer rescinded or a denial on your loan application due to poor credit. It may seem like an easy thing to ignore, but if you neglect to get the help you need, it’ll cause your finances to continue spiraling downward. And with all those extra fees and high interest rates, how are you ever supposed to catch up or get ahead? We’re here to tell you that there is a light at the end of the tunnel, and we will do everything in our power to restore your credit standing and help you through difficult times.

exposed to a world of entertainment, culture, and (yes, we’ll say it) fun! However, a few poor financial decisions in your youth or an unexpected medical emergency can quickly alter your lifestyle – and you’ll certainly pay the price if your credit standing is neglected. Just because you’ve hidden stacks and stacks of bills behind boxes of pasta in your pantry doesn’t mean these expenses have magically disappeared. The Phenix Group is here for you. Let us help you live a stress-free life by improving your credit score.