CHICAGO CREDIT REPAIR: ATTORNEY-POWERED CREDIT SERVICES

Infamous deep dish pizza, great architecture (who doesn’t love The Cloud Gate?), and a gigantic multicultural city that is a fraction of the cost to live in compared to LA or NYC – need we say more about Chicago? In addition to the attractive offerings of Chicago’s social scene, the city has a thriving economy, offering a mountain of employment opportunities for its residents. All these great attractions, and yet many Chicago residents are barely treading water when it comes to their credit scores. Chicago holds an average credit score of 648, a wildly low number in comparison to Illinois as a whole, which averages 671.

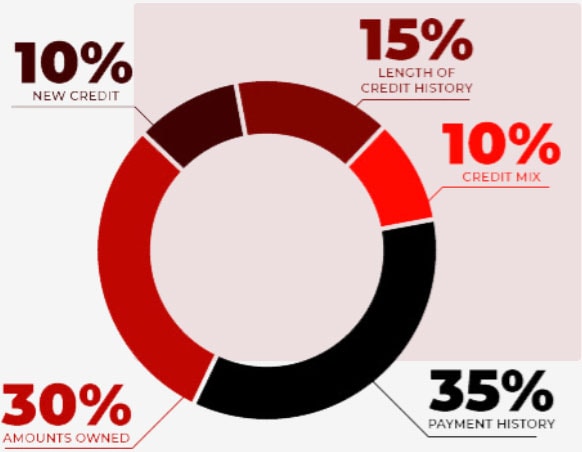

Creditors and lenders use a scoring system known as FICO®, which analyzes how likely you are to repay borrowed funds and calculates your credit risk. The scoring ranges from 300 to 850 and is determined by evaluating the following areas: your payment history, new credit, debt ratio, length of credit history, accounts owned, and your credit mix. Having a poor credit score is something anyone can experience. When the economy is suffering, you get laid off, or you’re hit with unexpected medical bills, financial hardship can quickly cause maxed out credit cards and unpaid bills. This is where credit repair experts in Chicago can step in to help you remove negative items from your report.

How Does Credit Restoration Work In Chicago?

When a few poor financial decisions cause your credit score to tumble into murky waters, it’ll have a massive impact on your life. Lenders will see you as a risky borrower, denying you financing for a new home in Chicago, college loans, or even that shiny new car you’ve had your sights set on. Because you’re classified as a high-risk borrower, you’ll be subject to higher interest rates and fees, loftier utility bills – costing you hundreds of your hard-earned dollars – and even make you vulnerable to pricey insurance premiums, all because of an unhealthy credit score.

As a Chicago native, possessing a bad credit score can completely disrupt your social, mental, financial, and even physical well-being. Your employment application may be denied as companies often factor poor credit into their decision-making process. And don’t be surprised to see your cell phone provider tack on an unexpected security deposit to compensate for the possibility of absorbing the cost of an unpaid contract. Chicago landlords are also wary of poor credit and will inflate your security deposit or decline your lease application as a way to protect themselves from potential loss of income.

Credit Repair Company Reviews

About Us and Credit Repair Dothan

The Phenix Group

When you partner with The Phenix Group, a legally compliant Chicago credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your credit repair needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Chicago Credit Repair

Working on credit, in a City near you

By leveraging an independent law firm and consumer protection laws, The Phenix group works to challenge and correct outdated or erroneous information on your credit report. Our Chicago credit repair services provide personalized and timely support, highly knowledgeable in Illinois debt collection laws, employing specialized dispute tactics to get bureaus and creditors to acknowledge inaccuracies, ultimately strengthening your credit score. Although creditors profit from poor credit reports, laws like the Fair Credit Reporting Act were enacted to protect consumers like you.

Bad credit can be scary, but it shouldn’t define who you are. The Phenix Group is passionate about liberating people from the fallout and repercussions of carrying around a poor credit score. Whether you have a few small issues or are in need of extensive credit repair, Chicago repair services can help. We help with charge offs, repossessions, debt settlement, dispute code removal, and more, all designed to help you reclaim your Chicago lifestyle, land a new employment opportunity, and finally move into that new home you deserve. We provide ethical and professional credit repair solutions that use regulation and laws to shield you from having to live in a never-ending nightmare of financial hardship. At the Phenix group, we are dedicated to helping you live a headache-free life and achieve your credit repair goals.