MIAMI CREDIT REPAIR SERVICES: ATTORNEY-POWERED CREDIT REPAIR MIAMI, FL

Residents in the Miami metro area, which covers West Palm Beach and Fort Lauderdale, are shouldering some of the highest credit card debt burden among Metropolitan regions in the country, with the average debt-per-consumer clocking in around $6,615. On average, the Miami area’s credit score of 644 is outpacing Florida as a whole, which is averaging a score of 642. Broken down by region, North Miami is averaging a score of 630 and Miami Beach is at 656.

Dubbed “The Magic City,” the Miami Metro area is quickly blossoming into one of the largest hubs for international business. The vibrant and diverse neighborhoods, vast employment opportunities, and breathtaking beaches are contributing to the area’s budding population growth, especially among young Millennial professionals. However, with an average mortgage debt of $197,410 and average student loan debt of $31,062, many Miami residents are struggling to boost their poor credit scores. Regardless of the factors that caused your credit to nosedive, you may feel like digging out of this hole is unattainable. But with credit repair in Miami, FL, there is hope for your credit score. You can call today to get a free credit repair analysis.

How Does Credit Restoration Work In Miami?

Our credit score specialists can help you create a healthy, handcuff-free financial future. By evaluating your credit, we are able to unmask the specific items that are damaging your credit score. We then build a comprehensive action plan focused on disputing negative items and removing false information to improve your creditworthiness. Our credit analysts and expert attorneys are well-versed in consumer law and will help you reverse poor behaviors, overcome credit-related challenges, and reach your goals in a timely and effective manner. While our digital world brings connectivity and better quality of life, it also breeds false advertisements and shady/dishonest online companies, claiming they can repair your scores. We want to put your mind at ease. As a legally compliant credit repair company, we are able to engage in meaningful work, helping our clients regain financial stability and finally grab hold of the things that were once out of their reach. We treat our clients like family, investing our time in gaining a robust understanding of each person’s unique challenges and goals to create a personalized roadmap for success. From loan consolidation to debt settlement, The Phenix Group in Miami, FL has all the resources you need to start improving your credit score today.

Credit Repair Company Reviews

About Us and Credit Repair Miami

The Phenix Group

When you partner with The Phenix Group, a legally compliant Miami credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your credit report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Miami Credit Repair

Working on credit, in a City near you

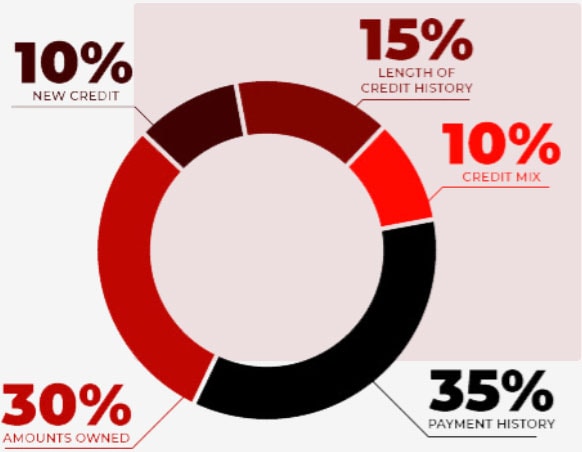

There’s no denying the thrill of purchasing a new car or finally receiving that stamp of approval for a loan on your new co-op. Your thoughts are most likely preoccupied with visions of road trips or dinner parties with friends and loved ones in your new home, and not only the subsequent bills that will begin making a regular appearance in your mailbox. But with every new purchase or loan, comes the opportunity for creditors to evaluate whether or not you would be able to repay future debts as agreed upon. Even the most fiscally responsible people wind up hitting a few unforeseen speed bumps in life. What was once a healthy credit score can take a turn for the worse if you consistently make late payments, default on a loan, fail to pay your bills, or declare bankruptcy. Even seemingly harmless mistakes, such as closing out an old line of credit or being a repeat offender when it comes to maxing out your credit cards, can brand you as a high-risk consumer. It helps to know Florida debt collection laws, find more on our blog.

These types of slip-ups will have a negative impact on your credit score, making it difficult for you to rent an apartment, get a new car, or receive a loan. Unhealthy credit scores will also cause your insurance premiums to skyrocket, and if you are approved for a loan, it’ll come with elevated rates and stricter contractual obligations.