ATTORNEY-POWERED CREDIT REPAIR WILMINGTON

Known for its historic riverfront, scenic beaches, and laid-back charm, Wilmington, NC blends coastal living with Southern hospitality. From the Cape Fear Riverwalk to nearby Wrightsville Beach, the area offers a strong tourism economy and growing real estate market. But as property values rise and the local cost of living follows, many Wilmington residents are struggling with credit card debt, medical collections, and low credit scores that limit their financial freedom.

At The Phenix Group, we provide credit repair services in Wilmington, NC backed by attorneys who know how to properly audit credit reports and dispute inaccuracies at the source. We help remove negative marks that may be holding you back from buying a home, securing a business loan, or simply getting approved for better credit terms. Our personalized process ensures each client receives a unique plan built for success.

📞 Contact us today for a free credit consultation and find out how our Wilmington credit experts can help turn your financial goals into reality.

How Does Credit Restoration Work In Wilmington?

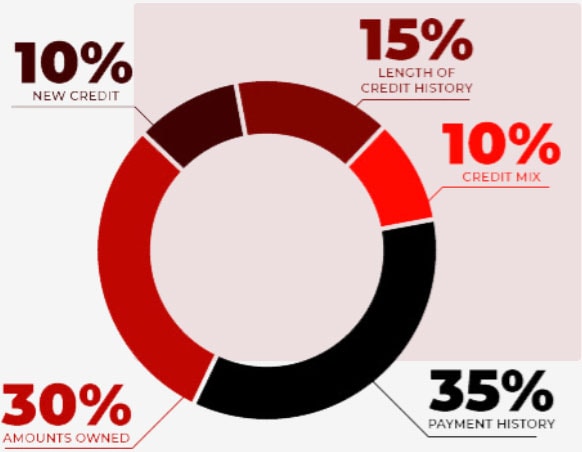

Creditors and lenders use the FICO scoring system to get insight into a person’s financial situation. It’s based on how responsible you are with your finances, particularly in regards to your payment history, new credit, debt ratio, accounts owned, and your credit mix.

This is defined by a three-digit score ranging from 300 to 850. The lower the number, the poorer your credit score, which can significantly affect your purchasing power since creditors and lenders will consider it risky to do business with you. You may then experience rejected loans, higher premium payments or interest rates, and additional fees on your bills, which are all tactics to incentivize you to make adequate payments on time.

Many people experience low credit scores due to bankruptcy, defaulted loans, or missed payments, but other uncontrollable factors may also lead to low scores, such as a suffering economy, massive company layoffs, or unexpected expenses (e.g. medical bills after an emergency).

Not all hope is lost, though. You can still take action to improve your credit with help from a credit repair company like The Phenix Group.

Credit Repair Company Reviews

About Us and Credit Repair Wilmington

The Phenix Group

When you partner with The Phenix Group, a legally compliant Wilmington credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Wilmington Credit Repair

Working on credit, in a City near you

Having a bad credit score can feel paralyzing, especially if you’re still trying to make ends meet to get through your day-to-day life. Problems can pile up as creditors and lenders will hesitate to do business with you, which can translate into rejected loan or credit applications, soaring interest rates, and added fees to your monthly bills. Of course, your FICO score shouldn’t define you, and it should definitely not hinder you from living the life that you deserve.

The Phenix Group leverages the knowledge and expertise of lawyers in finance to ensure that you get the help that you need to improve your credit. We’ll obtain your credit reports from all three major credit bureaus (TransUnion, Equifax, and Experian) and assess the information to pinpoint any errors. We’ll then help you dispute any mistakes to clean up your credit.

On top of this, we’ll offer professional guidance to help you sustain your financial responsibility so that you can work to keep your credit in good shape. The Phenix Group has helped countless clients with home ownership, business financing, and auto financing. We are here to help you achieve your goals!