ATTORNEY-POWERED CREDIT REPAIR RALEIGH

As the capital of North Carolina and a major anchor of the Research Triangle, Raleigh, NC is a city that blends innovation, education, and Southern charm. Home to leading universities like NC State, a booming tech sector, and a vibrant cultural scene, Raleigh attracts professionals, families, and entrepreneurs from across the country. From the North Carolina Museum of Art to the historic Oakwood neighborhood, the city offers a high quality of life—but with that comes rising housing costs and increasing financial pressure for many residents.

Despite Raleigh’s strong economy, many locals face credit challenges. Whether it’s from student loan debt, credit card issues, identity theft, or medical bills, even small financial missteps can damage your score and hold you back from reaching your goals. In fact, the average credit score in Raleigh still falls short of what’s needed to secure premium rates on home loans or business financing.

That’s where The Phenix Group comes in. Our Raleigh credit repair services are designed to help you regain control of your financial life. We use a legal, attorney-audited credit repair process to analyze your credit reports in detail, identify errors or unverifiable accounts, and dispute them with the credit bureaus on your behalf. Our team works closely with you to build a personalized credit improvement plan that supports your unique needs—whether you’re buying your first home, refinancing, or simply trying to rebuild your credit score.

We’re more than just another credit repair company in Raleigh—we’re a team of professionals committed to restoring your financial future with honesty, transparency, and results you can see.

📞 Call today for a free credit consultation and discover how The Phenix Group can help you achieve lasting credit restoration in Raleigh, NC.

How Does Credit Restoration Work In Raleigh?

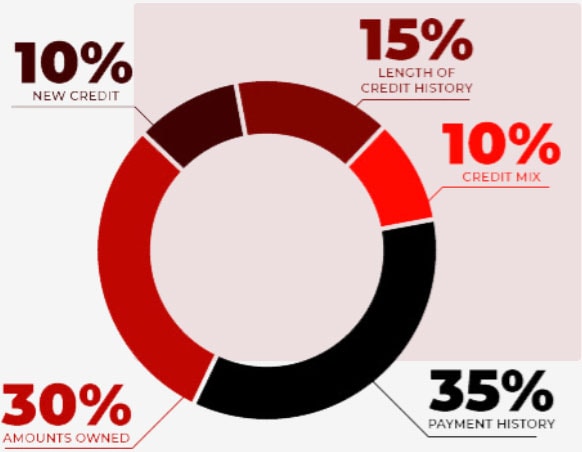

To determine your creditworthiness or the probability that you’ll pay back borrowed funds, creditors and lenders use the FICO® scoring system. To calculate your score, the system evaluates your financial health, factoring in things like the length of your credit history, payment history, debt ratio, the type of credit mix you have, new credit lines you’ve opened, and accounts with unpaid balances. All these factors are weighted based on importance to produce a score that ranges from 300 to 850. Many people struggle with financial hardship; it only takes a few missed payments or an unforeseen expense to find yourself face to face with a poor credit score. Once you possess a bad credit score, the repercussions aren’t pretty. You’ll see things like increased insurance premiums, high-interest rates on your credit cards or loans, additional fees tacked onto your utility bills, and denied loan applications. For our Raleigh credit repair services, we collect your personal credit reports from the three main reporting agencies – Experian, Equifax, and TransUnion. We pull reports from all three outlets to ensure we are identifying all inaccuracies or reporting errors that may be damaging your credit score. The Phenix Group’s credit analysts work on your behalf to fix outdated information and remove inaccurate data. Many times, there’s information that can no longer be verified, such as a reported item that came from a business that no longer exists, can be removed from your report.

Credit Repair Company Reviews

About Us and Credit Repair Raleigh

The Phenix Group

When you partner with The Phenix Group, a legally compliant Raleigh credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Raleigh Credit Repair

Working on credit, in a City near you

At The Phenix Group, we have a vast knowledge of consumer protection laws, as well as years of industry expertise to facilitate the San Diego credit repair process. When you possess bad credit, you run the risk of receiving loan denials or having your new job opportunity rescinded. When people neglect to get help, their finances continue to plummet into a dark hole. After all, if you’re being charged higher insurance premiums, high-interest rates, and extra fees on your monthly bills, how are you supposed to get ahead? If you feel handcuffed to your poor credit score, remember there is a light at the end of the tunnel, and we can help you repair your credit standing. When you’re living in The Triangle, you never know what life may throw at you.

Maybe you made a couple of mistakes in your youth and now you’re paying the price. Or, maybe you had to help a family member with a medical emergency, and it left you with stacks upon stacks of bills. Whatever circumstances may have led you to have poor credit, The Phenix Group is here to help. From dispute code removal to debt settlement assistance, our team is dedicated to helping you get your finances back on track.