CREDIT REPAIR SERVICES:ATTORNEY-POWERED CREDIT REPAIR Atlanta, GA

With all its southern charm, award-winning restaurants, and cultural opportunities, Atlanta has become one of America’s fastest-growing metropolitan cities. The Georgia capital’s flourishing commerce, employment opportunities, and attractions have been luring newcomers to this part of the country in recent years. With all this appeal, however, Atlanta residents are fighting an uphill battle when it comes to their credit scores, sporting an average of 662.

According to the credit reporting agency, Experian, Atlanta is one of the top 15 US cities with the highest credit card debt, with locals shouldering an average of $6,907 in owed funds. Credit scores range between 300 and 850 and are calculated by a scoring system known as FICO®. When you have a poor credit score, lenders and creditors will see you as a risky borrower, which could lead to denied loan applications, high interest rates, pricey insurance premiums, and added fees tacked onto your month utility bills. But for Atlanta residents, there’s a solution. The Phenix Group offers personalized credit repair solutions to help individuals improve their credit score and financial standing.

How Does Credit Restoration Work In Atlanta?

The experienced credit analysts at The Phenix Group will examine every aspect of your financial picture, placing an emphasis on your credit report, to help redirect you onto a healthier path. Together with an independent law firm, our specialists will go over your credit reports with a fine-toothed comb to correct and get rid of errors and inaccuracies that are hurting your current credit standing. Because everyone’s goals and challenges are unique, we create personalized programs that are focused on helping you achieve your goals – whether that’s purchasing a new home or scoring some new wheels. Without repairing a bad credit score, you’re vulnerable to setbacks, such as being unable to purchase a house or land a new employment opportunity.

Credit Repair Company Reviews

About Us and Credit Repair Atlanta

The Phenix Group

When you partner with The Phenix Group, a legally compliant Atlanta credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Atlanta Credit Repair

Working on credit, in a City near you

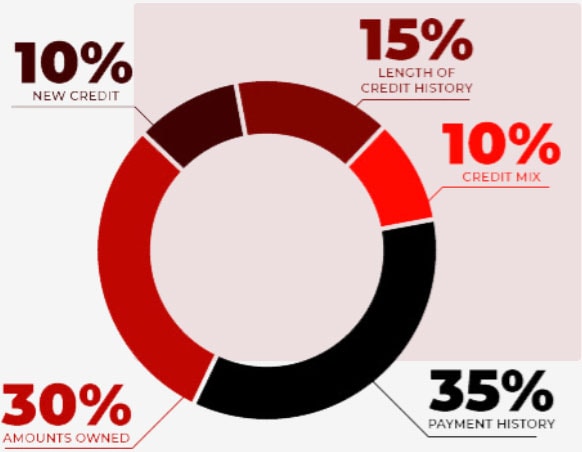

Both intentional and unintentional financial actions are used to determine your credit score and measure the likelihood of you returning borrowed funds. The length of your credit history, lines of credit, the type of credit mix you possess, how often you make on-time payments, and your total debt are factors used to calculate your credit score. Creditors and lenders use your credit report as a predictor of your poor future behaviors, such as continually missing payments or the probability that you’ll default on a loan.

Maxing out credit cards and failure to pay your bills will easily send you spiraling into financial hardship, especially if you are someone who lives paycheck to paycheck. Know the difference between debt consolidation versus credit card refinancing. The good news is, you’re not alone, and bad credit can happen to anyone for any number of reasons. At the Phenix Group, we work to repair your credit quickly and efficiently, providing you with the resources and financial education you need to improve your credit for the long-haul.