DENVER CREDIT REPAIR-ATTORNEY-POWERED CREDIT REPAIR

Denver, Colorado may have started as a hub for gun-slinging gold miners, but the Centennial State has come a long way since then. Now, the residents of the Mile-High City are known for their laid-back lifestyle, dedication to fitness, and their love for the beautiful outdoors. While the time of the gold-rush may have passed, Denver is now experiencing a different sort of rush – marijuana. Due to the state legalizing marijuana-related products, Denver has seen a major boost to its economy in recent years. Despite all of its attractions, the average Denver resident is clocking in at 668 when it comes to their credit scores. Could it be because the average monthly rent is $1,203? Or, that the average house costs about $393,842? Either way, Denver, CO residents are in need of some serious credit repair.

How Does Credit Restoration Work In Denver?

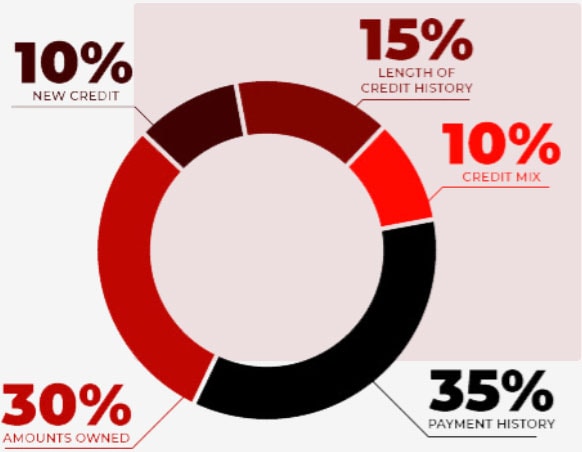

A credit score can range anywhere between 300 and 850. Credit scores are calculated using a popular scoring system known as FICO®. When your credit score falls onto the lower end of the spectrum, creditors and lenders will categorize you as a “risky borrower.” You may look at your low credit score and think, “who cares”? However, the reality is a low credit score means high-interest rates, added fees on monthly bills, denied loan applications, and higher insurance premiums. But just because you possess a poor credit score does not mean there isn’t a solution for Denver credit repair. The Phenix Group is here to provide you with a personalized credit repair plan that’s ultimately designed to help increase your credit score. Your total debt is examined, along with your credit history; to determine your level of financial responsibility. Think of it as an algorithm used to determine whether or not you will be able to repay borrowed funds. Carrying the weight of your credit mistakes sure doesn’t equate to a good time, but don’t forget, anyone can go through a rough patch in life. Whether you maxed out multiple credit cards or defaulted on a loan, The Phenix Group recognizes that anyone can fall victim to a poor credit score. That’s why we provide credit repair for even those carrying shockingly low credit scores.

Credit Repair Company Reviews

About Us and Credit Repair Denver

The Phenix Group

When you partner with The Phenix Group, a legally compliant Denver credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Denver Credit Repair

Working on credit, in a City near you

The Phenix Group consists of a number of experienced credit analysts and has partnered with an independent law firm to assess your finances and help repair your credit standing. Having done this for a number of years, The Phenix Group will work tirelessly to identify inaccurate information that could hurt your credit. Often your Credit Karma is pulling bad information and factoring in paid-off credit cards and credit fraud when it reports a low score.

No matter who you are or what your occupation is, The Phenix Group fits their program to meet your individual needs.The Phenix Group’s number one priority is to address your credit score and help you build a better financial future for yourself. Committed to ensuring that your credit score improves, our legally compliant repair company will ensure you gain the credit freedom you’ve been looking for. Bye-bye, debt collectors.