ATTORNEY-POWERED CREDIT REPAIR SAN DIEGO

With beautiful beaches, world-class attractions like the San Diego Zoo, and a booming biotech and military economy, San Diego, CA offers an unbeatable lifestyle. However, the high cost of living in this coastal paradise has contributed to rising debt and stagnant credit scores for many residents.

The Phenix Group offers tailored credit repair services in San Diego to help individuals correct errors, remove outdated items, and increase their credit scores legally and efficiently. Whether you’re looking to buy property in La Jolla or refinance in Chula Vista, our expert team is ready to help.

How Does Credit Restoration Work In San Diego?

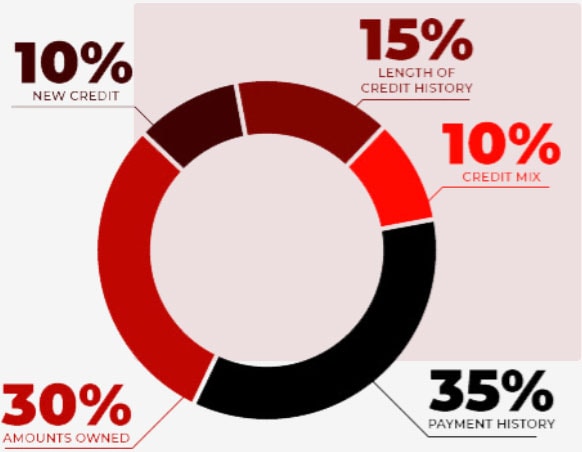

Often called the birthplace of California, San Diego’s current credit standing as a whole was born from both intentional and unintentional financial actions. To measure the likelihood that you’ll be able to return borrowed funds, your lines of credit, length of your credit history, whether or not you make on-time payments, the credit mix you possess, and your total debt all factor into the equation that ultimately produces your credit score. Your credit report essentially acts as a predictor of your future financial behaviors – such as the likelihood that you’ll default on a loan or the probability that you’ll frequently miss monthly payments. Things like neglecting to pay your bills and frequently maxing out your credit cards can be incredibly detrimental to your financial health, especially if you are living paycheck to paycheck. At the Phenix Group, we know bad credit can happen to anyone. That’s why we provide San Diego credit repair and financial education to help you improve your credit standing long-term. The Phenix Group is home to a number of experienced credit analysts who will assess every piece of your financial picture, with a special emphasis on your credit score, to help you feel burden-free again. Our specialists, along with an independent law firm, will meticulously rake through your credit reports to identify any erroneous or inaccurate information that may be hurting your credit score. We understand that each of our clients has their own unique set of challenges and goals and that’s why our program is customizable to fit your needs. If you continue moving forward without repairing your poor credit, it’ll leave your vulnerable to difficulties, such as the inability to purchase a home, high fees on your monthly utility bills, and trouble landing a new employment opportunity.

Credit Repair Company Reviews

About Us and Credit Repair San Diego

The Phenix Group

When you partner with The Phenix Group, a legally compliant San Diego credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law and new debt collection laws of 2022, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

San Diego Credit Repair

Working on credit, in a City near you

Credit scores can range anywhere from 300 to 850 and are calculated based on a popular scoring system known as FICO®. For those branded with a poor credit score, creditors and lenders will put you into the “risky borrower” category. What does that mean for you? High interest rates, denied loan applications, added fees tacked onto your monthly bills, and pricy insurance premiums.

Thankfully, there’s a solution for San Diego credit repair. The Phenix Group provides a personalized credit repair plan designed to boost your credit score. Not only is the Phenix Group a legally compliant credit repair company, but we also have an amazing staff with extensive knowledge of credit restoration and consumer laws. We’re committed to helping restore your financial wellbeing so you can enjoy the many restaurants, museums, and entertainment that San Diego has to offer. Regaining control over your finances means no more headaches, fees, or loan denials. We can wait to help you improve your credit score!