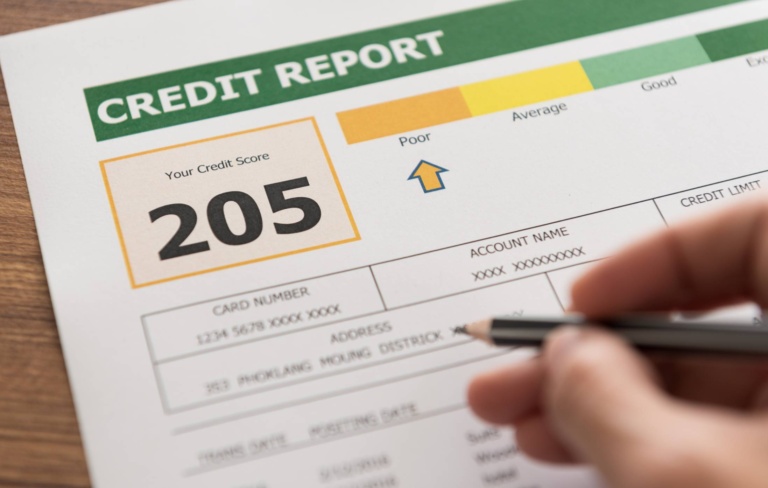

More than 77% of Americans over the age of eighteen have at least one credit card. Unfortunately, 54% of adults never check their credit scores. This puts them at an increased risk of fraud and identity theft–and many end up wondering how much a credit repair lawyer costs.

The good thing is, you get three free credit reports every twelve months. A credit report is a detailed record of your credit history that’s compiled by a credit bureau. It contains information about your borrowing and repayment activities, helping lenders and creditors assess your creditworthiness.

However, there are different types of credit reports, and these can vary based on which bureau supplies the information to create them. Each bureau uses its own method for collecting your credit data, presenting it, and calculating your credit score, which can vary by day of the month. This means all three reports have value, and none is better than another.

So, if you’re looking to get a new credit line or approved for a mortgage or auto loan, your potential lender will most likely check your credit history with all three bureaus to ensure they know everything.

What’s in a Credit Report?

While there are various credit reports, they all have the following details:

Personal Information

Your credit report may include the following personal information:

- Name

- Date of birth

- Social Security number

- Address (previous and current)

- Phone number

- Employment information (past and current).

Credit Accounts

Under the credit section, you’ll find the following information:

- Account balance

- Account types, such as a mortgage, installment loan, or revolving credit

- Lender name

- Loan amount or credit limit

- Payment history

In this section, you may also see a record of collections–this is created when a lender reaches out to collect an outstanding debt. However, some lenders may list this in a separate column.

Credit Inquires

You’ll find two types of inquiries on your credit report: hard and soft.

- Hard inquiries: These appear on your credit report when you apply for a mortgage, loan, or credit card, and your lender checks your credit. These inquiries lower your credit score by several points and stay on your credit reports for two years.

- Soft inquiries: These occur when a lender takes a look at your credit as part of a routine or background check. They don’t affect your credit score and may not even be recorded in your credit report.

Public Records

Your credit report may list publicly-sourced financial information, such as bankruptcies, tax liens, civil suits, and foreclosures. Bankruptcies and foreclosures can appear on your credit report for up to seven to ten years, depending on the type of bankruptcy.

Credit Reporting Bureaus

There are three credit reporting bureaus that publish credit reports every year. These are:

Experian: This is the largest credit reporting agency worldwide, operating in forty-three countries across the globe.

TransUnion: While relatively smaller than its counterparts, TransUnion provides credit reporting services to countries like the UK, India, Canada, and Brazil. Within the US, it provides services in the Midwest and East Coast regions.

Equifax: This is the dominant credit monitoring and reporting agency in the southern US and competes with TransUnion for market dominance in the Midwest.

Lenders, landlords, and employers use reports provided by all three agencies to make important decisions, such as approving you for a loan.

How to Get a Copy of Your Credit Report

Experian, TransUnion, and Equifax offer three free credit reports per year. However, as of June 2023, they’re currently offering free weekly online reports.

If that’s not enough, you can pay a minimal monthly fee to check your credit score on demand or receive credit alerts. If you find your credit score is disappointing, professional credit repair services are worth it–contact The Phenix Group today, and we’ll help get your credit health back on track!

Wondering how much credit repair companies charge? We’ve got your back–take a look at our recent article.