CREDIT REPAIR SERVICES: CREDIT REPAIR LAWYER-CREDIT REPAIR DALLAS, TX

According to Experian, the average debt per consumer in Dallas, TX is nearly $30,000, placing local residents among the most indebted in major metro areas across the United States. Even more concerning, Dallas also ranks among the cities with some of the lowest credit scores in the nation. The median Dallas credit score is 708, but over 51% of consumers fall into the “very poor” (300–549) or “poor” (550–649) credit range.

As Dallas continues to thrive (especially Area Codes:75201, 75204, 75206, 75214, 75219, 75228, 75287) —from the bustling downtown Arts District and booming tech sector to the upcoming 10,000-acre urban park that will be over 11 times the size of Central Park—so do the living expenses. Rising housing costs, competitive job markets, and increasing financial pressures are leaving many residents struggling to stay ahead.

If you’re one of the many seeking credit repair in Dallas, The Phenix Group is here to help. As a top-rated Dallas credit repair company, we specialize in attorney-backed credit audits, accurate dispute filing, and customized restoration plans that help you raise your score, improve your financial standing, and qualify for the life you deserve—whether it’s homeownership, auto financing, or simply peace of mind.

📞 Call today for your free credit consultation and start working with Dallas credit experts who understand your challenges and deliver real solutions.

How Does Credit Restoration Work In Dallas?

If you have bad credit, and live in Dallas, not only can lenders deny your application altogether, but if approved, you’ll encounter higher-than-average interest rates on your mortgage loan and credit card, as well as pay an inflated premium for car insurance.

Living with bad credit can feel like you’re walking through life with shackles tethered to your arms and legs. This is where we intervene with credit repair Dallas. Our client-focused credit analysts and expert attorneys, skilled in consumer law, will conduct a personalized audit to understand your challenges, the factors and behaviors driving your poor credit score, your goals, and what your time frame looks like. We have a credit repair lawyer who works in conjunction with our process.

Credit Repair Company Reviews

About Us and Credit Repair Dallas

How Does Bad Credit Happen in Dallas, Tx?

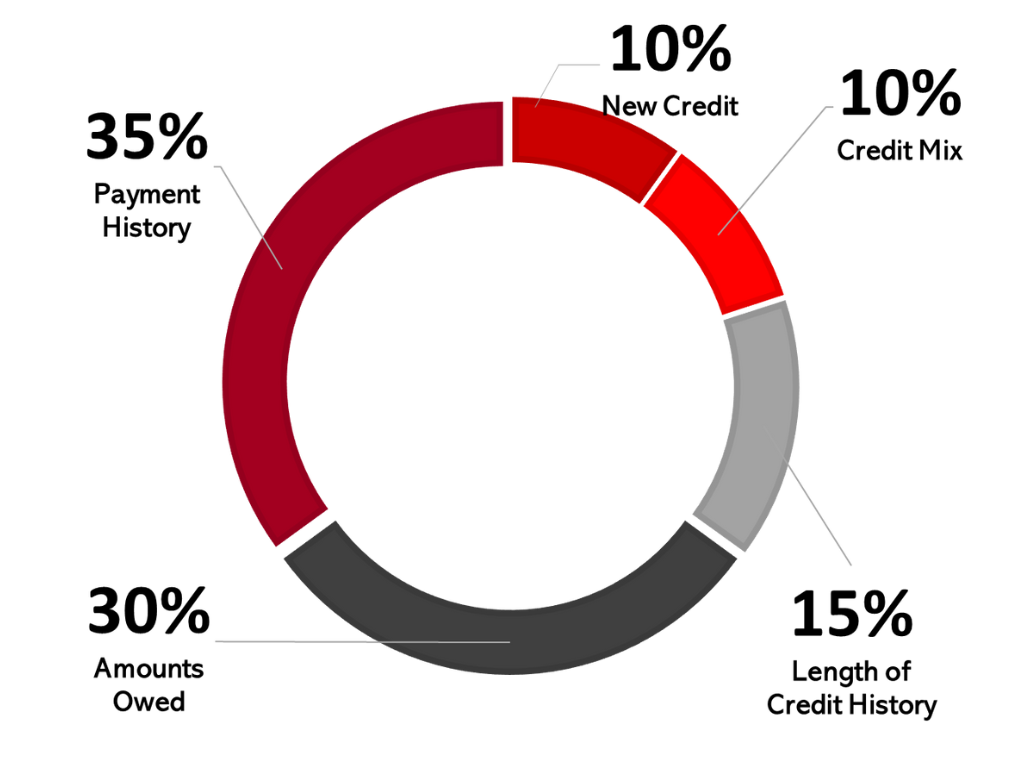

Although poor credit scores are often a product of our actions, even the most responsible individuals encounter unexpected roadblocks that completely derail their once-healthy credit score. Becoming familiar with the factors that lead to bad credit will allow you to take preventative measures in the future and maintain your repaired credit score. Common areas that negatively impact your credit score include failure to pay bills, making late payments, declaring bankruptcy, and defaulting on a loan. These mistakes can cause your credit score to take an unhealthy nosedive – and they aren’t the only factors that can guide your score down a dicey path. Some less obvious, but equally powerful, slip-ups revolve around your credit card use. Closing old lines of credit, even ones with a zero-balance, or worse, canceling a credit card before you’ve paid any outstanding balances will reflect poorly on your score. In addition, if you frequently max out your credit card, despite making consistent or in-full payments, it can adversely affect your credit standing.

How We Offer Our Credit Repair Dallas, TX

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Credit Repair Lawyer-if necessary

- Step 4: Credit Ready

Credit Repair Dallas, TX

Working on credit repair Dallas TX

Disreputable firms, phony advertisements, and companies that mimic the used car salesman persona have not done any favors for the credit repair industry. We work in conjunction with a credit repair lawyer to ensure the best results. Not only are we a legally compliant Dallas credit repair company, but at the heart of our business is integrity and care for our clientele.

Resolving our clients’ challenges and providing them with the stepping stones necessary for realizing their goals is the pulse that keeps our company beating. From debt settlement to loan consolidation to charge offs, The Phenix Group is ready to help you improve your credit and lifestyle today.