ATTORNEY-POWERED CREDIT REPAIR CHARLOTTE

A bustling metropolitan scene paired with classic southern charm is what makes Charlotte, NC such an attractive place to live. This melting pot is made up of young professionals and families alike, all of which enjoy the world-class restaurants, nice weather, and lively music events. While North Carolina is ranked one of the best states for business, those living in sunny Charlotte are shouldering some pretty poor credit scores. With an average credit score of 666 Charlotte residents are sitting at the bottom of the barrel when compared to other North Carolina cities.

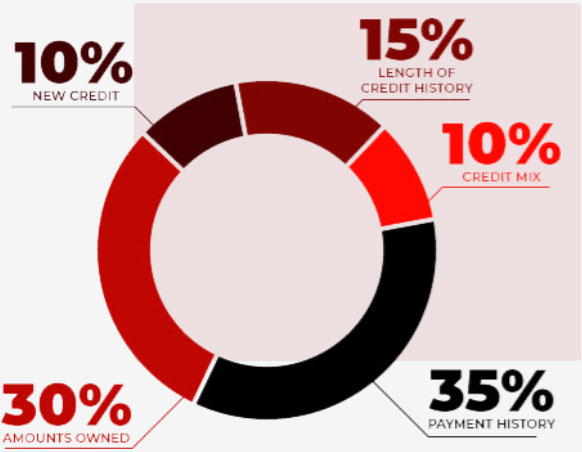

So, how exactly is this score generated? The three-digit number comes from a scoring system known as FICO®. Creditors and lenders will use your credit score to evaluate your financial stability and the likelihood that you’d repay borrowed funds. When you have a bad credit score attached to your name, it can completely disrupt your life, leaving you to face high interest rates, loan denial, fees tacked onto your monthly bills, and jacked up insurance premiums. At The Phenix Group, we work with you to improve your financial standing and help you travel in the right direction towards your desired lifestyle.

How Does Credit Restoration Work In Charlotte?

Everyone is vulnerable to hitting a few financial hiccups. Unexpected life events and expenses can lead to missed payments, defaulting on a loan, and the inability to keep up with your pile of bills. The Phenix Group, along with an independent law firm, will partner with you to take a 360-degree look at your finances, gathering your credit reports from each of the main agencies – Experian, TransUnion, and Equifax. Our team of credit analysts expertly comb through your reports to identify and eliminate erroneous and inaccurate information that’s damaging your financial standing. Because everyone’s story is uniquely their own, we create customized solutions to tackle your biggest challenges and help you achieve your goals.

Many people mistakenly think that all three of their credit reports are identical. In reality, each reporting agency may hold different information, and that’s why it’s essential to comb through all three. Whether there’s data reported from an insolvent business and can no longer be verified, or your personal details are completely wrong, our credit specialists will call upon their experience and knowledge of consumer law to work with creditors and lenders to resolve these issues.

Credit Repair Company Reviews

About Us and Credit Repair Charlotte

The Phenix Group

When you partner with The Phenix Group, a legally compliant Charlotte credit restoration company, boosting your credit score is a simple, achievable goal. By first obtaining your credit reports from the three main reporting agencies, Equifax, Experian, and TransUnion, our credit-savvy analysts are able to identify any inaccuracies that are on your report. From having your personal information listed incorrectly to lender reporting errors, The Phenix Group and our expert attorneys, who are skilled in consumer law, will work on your behalf to have any unfair or incorrect items taken off of your credit report. We dedicate the care and respect each of our clients deserve towards understanding the factors responsible for your poor credit score, including your financial challenges, goals, and how quickly you need to improve your credit standing. We custom-build an action plan that specifically tackles your needs so you can finally lower those astronomical interest rates, purchase the house of your dreams, or buy that new car you’ve been pining for. We are so passionate about improving lifestyles, that once we increase your credit score, our credit services will give you the tools needed to set up your financial future for success.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

Charlotte Credit Repair

Working on credit, in a City near you

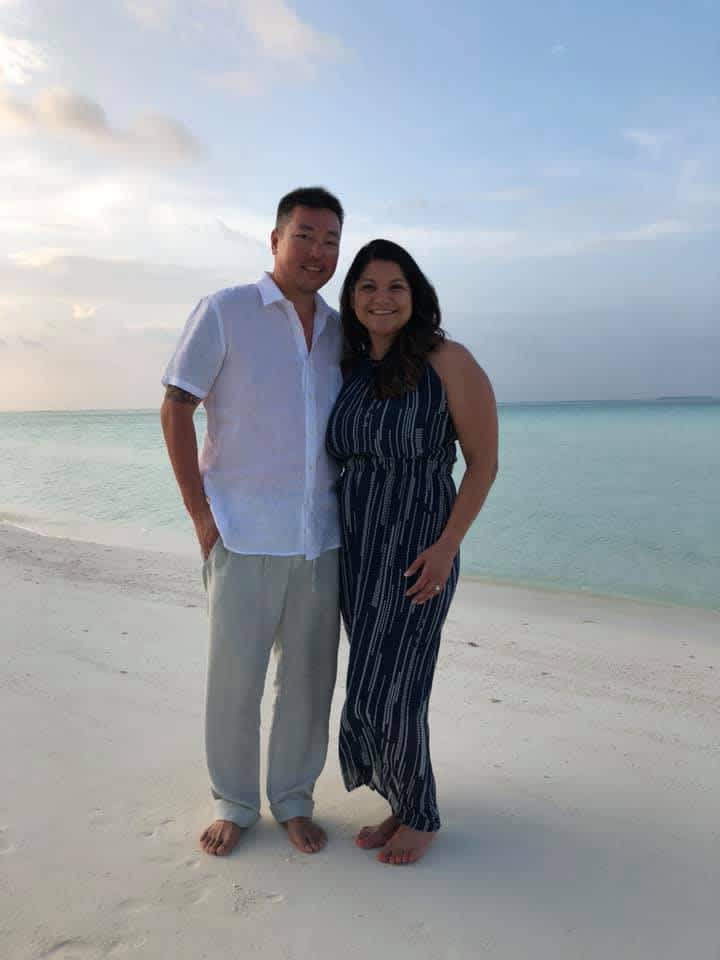

From an unforeseen layout to mishandling your credit cards, just a few financial mistakes and lead you down a risky path – one that brandishes you with a poor credit score. It can happen to even the most organized, financially responsible individuals. Because, as we all know, life can throw curveballs at us when we least expect it. Managing a mountain of bills while a debt collector attempts to hunt you down for unpaid funds is no way to live.Whether you’ve filed for bankruptcy, or you fell way behind on mortgage payments, these types of errors can cause your financial health to plummet. With a poor credit score, creditors and lenders will see you as a high-risk borrower and can either refuse to do business with you or charge you astronomical interest rates. Rather than endure the stress of financial instability, The Phenix Group can help you find a solution and improve your credit score.

From credit coaching to repossessions to debt settlement, The Phenix Group is committed to helping you reclaim a healthy financial picture. We believe everyone deserves the opportunity to correct financial errors and live the life they’ve envisioned for themselves. Whether your goal is to purchase a new home for your family or you’re in need of a new set of wheels, our credit specialists will pave the way for you to get there. By reversing the damage of possessing a bad credit score, you’ll be able to return your focus to the things that matter most in life.