Getting behind on payments can happen to anyone, and once it starts, it can feel like there’s no end in sight. Watching your credit card build up to a place where you’re not able to make payments can lead to falling behind on bills, becoming extremely overwhelming–this can lead to a charge-off. A charge-off can potentially be removed by a legitimate credit repair company, or the company can at least help limit the damage done to your credit.

What Is a Charge-Off?

A charge-off happens when you fail to make payments you owe. The money will then be transferred to either a debt-buyer or a collection agency. The time frame can vary on how long it takes for the charge-off to occur, but typically, the timeline is between 120 and 180 days of not making payments to your bill.

How Will I Know if My Bill Is Going to Become a Charge-Off?

You will likely receive multiple phone calls and letters to notify you about your bill and payments being due before it becomes a charge-off.

If My Debt Is Sold to a Debt-Buyer or Collection Agency, Do I Still Have to Pay It?

Yes–you will still have to make payments and pay off the debt and this will show up on future credit reports. The charge-off account can be on reports up to seven years from the initial missed payment.

How Do I Get a Charge-Off Removed?

First thing you should do is work to pay off your bill. You can work alongside a financial advisor to help with your credit score, as well as to help learn how to pay off your debt and become financially successful. An advisor will work alongside you, review payments you owe as well as your income, and other expenses you may have to help you pay off your bills.

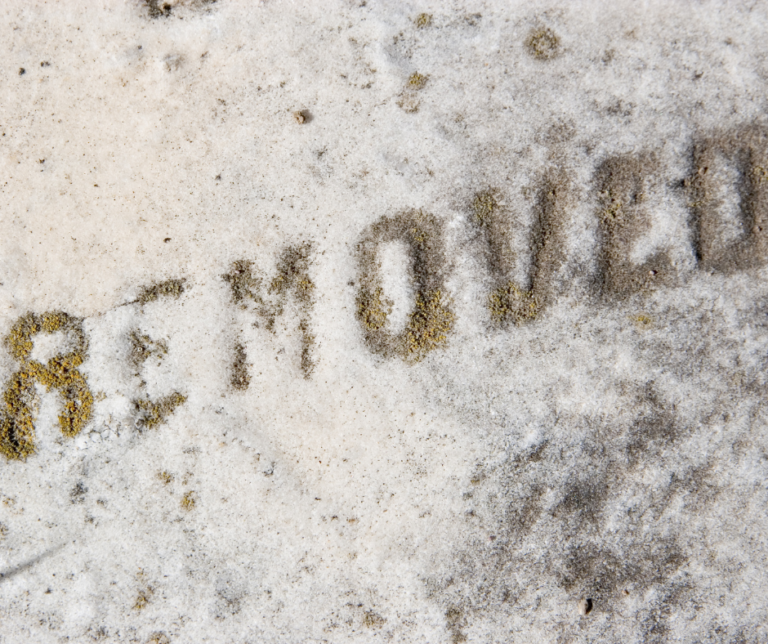

You can work with a credit repair company to negotiate your charge-off to be removed from your credit report. The owner of the debt may be open to allowing you to pay to remove the charge-off.

Some experts suggest offering a portion of your debt if the sum is large, as the collection agency bought your debt for a fraction of the full amount. They may push back, but you can work to negotiate paying a sum of the debt you’re able to afford. If the balance is smaller, you will likely have to pay the entire sum.

If your charge-off was incorrect, you can contact the credit bureau directly in writing to alert them the charge-off is not valid. You will be able to send a dispute letter with details on why the information is incorrect and what you would like to have removed.

How Can I Rebuild My Credit After My Charge-Off Is Removed From My Account?

Rebuilding your credit will take time, hard work, and patience–but it can be done. After a charge-off gets added to your account, it will drop your credit to a very low score. To rebuild this, you can work to pay off any other debts you have, make sure to make payments on time, and keep a low balance on your accounts. The experts at The Phenix Group are ready to work with you to help you raise your credit score after a charge-off!

Wondering if you can get inquiries removed from your credit report? Check out our latest post!