ATTORNEY-POWERED CREDIT REPAIR SAN ANTONIO

San Antonio, TX, home to the historic Alamo and attractions like SeaWorld and Six Flags Fiesta Texas, offers a rich blend of culture, family-friendly events, and a thriving job market with major employers such as Citigroup, Lockheed Martin, and AT&T. But while the local economy is strong, many San Antonio residents face serious financial challenges. According to Experian, San Antonio holds one of the highest average consumer debt levels in the country—around $31,053 per person—and a below-average credit score of 649.

If you’re struggling with credit card debt, collections, late payments, or other negative items, The Phenix Group can help. Our credit repair services in San Antonio are backed by an attorney-audited process that helps remove inaccuracies and rebuild your score. Don’t let bad credit hold you back from enjoying all the opportunities San Antonio has to offer.

📞 Call now for a free consultation and take the first step toward a stronger financial future with expert credit repair in San Antonio, TX.

How Does Credit Restoration Work In San Antonio?

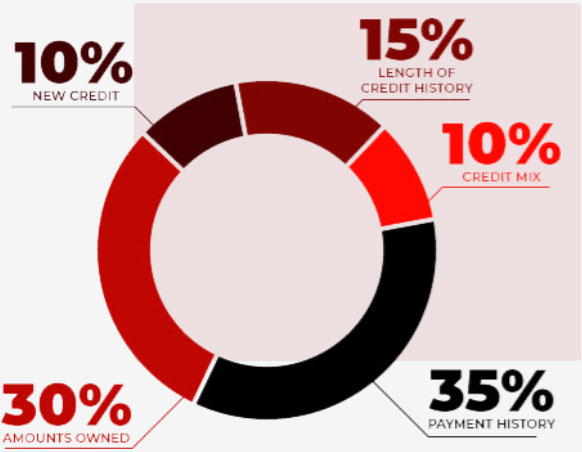

Your three-digit credit score is calculated based on a formula created by FICO®, which analyzes your payment history, types of credit, outstanding balances, debt ratio, new credit lines, and length of your credit history. When you have a poor credit score, lenders and creditors will classify you as a high-risk borrower, severely diminishing your purchasing power when it comes to buying a new home or car. Facing the negative impacts of a bad credit score isn’t a weight you have to bear forever. With The Phenix Group’s credit repair solutions, we are committed to helping San Antonio residents improve your credit score and rebuild your financial wellbeing so you can get back to the life you deserve.

As a credit restoration company, The Phenix Group collects and analyzes your consumer credit report to create a customized solution to help you improve your credit score. Our credit analysts, together with an independent law firm, challenge outdated, inaccurate, or unverifiable data, such as lender reporting errors or incorrectly listed personal information, to remove errors and improve your financial standing. If there’s a negative item on your report that came from a lender that has since gone out of business, the information previously reported would be unverifiable and thus eligible to be removed.

Credit Repair Company Reviews

About Us and Credit Repair San Antonio

The Phenix Group

Once a bad credit score infiltrates your life, it can prevent you from getting a new job or apartment, and severely limit your financial mobility. Liberating yourself from the endless cycle of denied applications, high interest rates, revoked job offers, and anxiety-filled afternoons dodging debt collectors is why we love what we do. The Phenix Group is dedicated to helping any San Antonio, TX resident in need, and will work quickly to increase your credit score so you can finally reclaim your financial security. When combined, ‘bad’ and ‘credit’ are two of the most dreaded words one can hear – and can take a complete toll on someone’s life. As a credit repair company working in San Antonio, The Phenix Group believes your financial mistakes shouldn’t follow you year after year and become a defining factor in your life. From debt settlements to loan consolidations, we tackle your unique credit challenges to improve bad credit scores and ensure you get back to enjoying the Tex-Mex in Southtown and the San Antonio Spurs as soon as possible.

How We Offer Our Credit Repair Service

- Step 1: Free Consultation

- Step 2: Individualized Plan of Action

- Step 3: Attorney Engagement-if necessary

- Step 4: Credit Ready

San Antonio Credit Repair

Working on credit, in a San Antonio, TX

Life can be one big juggling act. Maintaining a healthy financial picture when your balancing work, family obligations, household chores, errands, and a social life is no easy feat. Unexpected circumstances, such as unforeseen medical bills or a job loss, can quickly snowball into a charge off from failed credit card payments or defaulting on a loan. Sometimes, we get caught up in the allure of a new purchase, like taking your new ride for a spin down the highway, and we forget about the financial obligations that come along with each credit card swipe or application approval. Mistakes happen, meaning anyone can harbor a less-than-stellar credit score.

However, lenders use your credit score to measure your creditworthiness – i.e. your current and future ability to repay loans and be fiscally responsible – and can choose not to do business with you. Even seemingly harmless mistakes, such as a few missed payments, can lead to your loan or mortgage application being denied. Those with bad credit can also face extremely high interest rates when applications are approved. Over time, poor credit and financial instability can completely disrupt your life and interfere with achieving the goals you set out to accomplish.